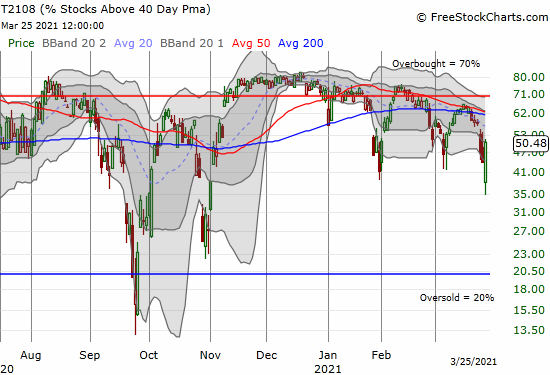

Small Caps Drove A Bullish Expansion of Market Breadth

Stock Market Commentary The market took just one more day to resume the momentum of expanding market breadth. An extreme October set up this bullish start to November with fresh all-time highs for major indices. While small caps as a group just missed an all-time high, the surge in small caps drove a bullish expansion … Read more