How to Protect Gains After Surviving A Stock Market Sell-Off

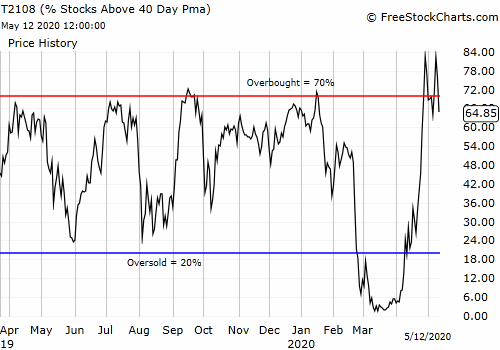

The stock market crash in March was stomach-churning and generated a lot of panic. At its lowest point, the S&P 500 (SPY) was down 33.9% from its all-time high set just the previous month. The rebound from that stock market sell-off has been heroic with a 32.1% gain taking the index within another 14.6% rally … Read more