The Federal Reserve gave tacit approval to the unfolding summer of loving stocks. In its June decision on monetary policy, not only did the Fed hold interest rates steady, but also it rolled out improved overall forecasts for the economy. GDP growth for this year went from 0.4% to 1.0%, presumably lowering the odds for a second half recession. The unemployment forecast dropped from 4.4% to 4.1%. Forecasts for 2024 and 2025 changed ever so slightly while long-run projections stayed the same. While Fed Chair Jerome Powell reiterated that “reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions”, clearly both are proving quite resilient in the near-term. Accordingly, the Fed’s expectations weakened any case for an economic catalyst to ruin the summer of loving stocks.

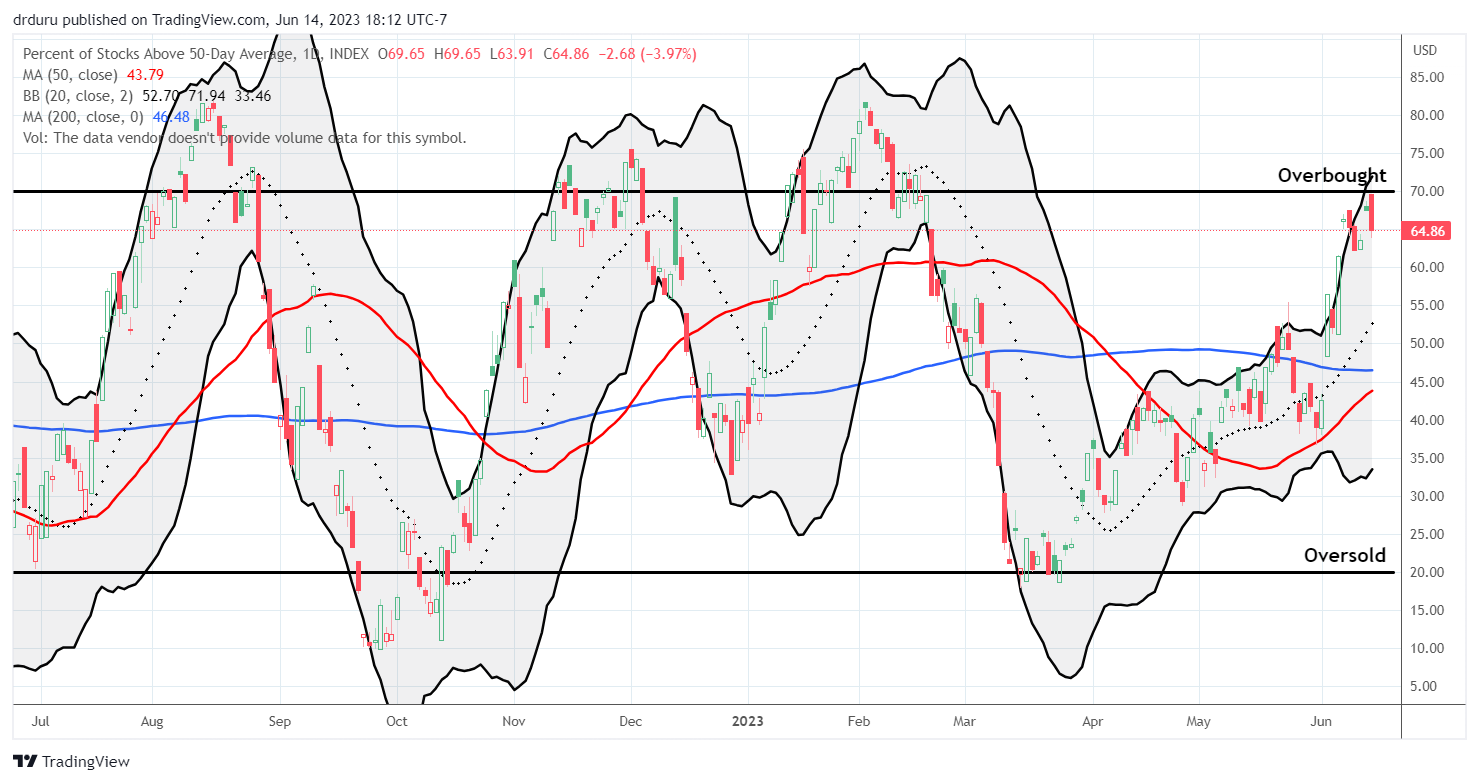

The S&P 500 (SPY) and the NASDAQ recovered from intraday disappointments and closed with tiny gains on the day. The iShares Russell 2000 ETF (IWM) lagged with a 1.1% loss and dragged market breadth down. My favorite technical indicator, AT50, the percentage of stocks trading above their respective 50-day moving averages (DMAs), faded intraday from the overbought threshold of 70% and closed at 65%. AT50’s continued tease under the overbought threshold means the Fed won the initial round of its collision with overbought trading. The traditional post-decision Fed speak will give the market more opportunities to create excitement around the overbought threshold.

The S&P 500 is already up 4.0% since summer trading began (the first trading day after Memorial Day). The NASDAQ (COMPQX) is up 5.0%. I took profits on a QQQ calendar spread and am still holding a QQQ August 365/380 call spread, both positions I initiated last week. Today, I bought an IWM 185/190 call spread expiring next week.

The stock market bears who are still leaning against the market’s momentum got a small bone to nibble: inflation promises to linger as a nagging problem for the economy. The Fed increased its expectation for core PCE (personal consumption expenditures) inflation from 3.6% to 3.9%. This notable increase explains chair Jerome Powell’s complaint that core PCE remains too sticky and stubbornly high. Accordingly, the expectations for the Federal funds rate went higher. The “higher for longer” narrative for rates is as strong as ever.

Still, the Fed only boosted the low end of its ranges on rates. The rate for 2023 went from a range between 5.1% and 5.6% to between 5.4% and 5.6%. The rate for 2024 went from a range between 3.9% and 5.1% to between 4.4% and 5.1%. Only in 2025 does the top of the range nudge higher. The expectation for the Federal funds rate went from a range between 2.9% and 3.9% to 3.1% and 3.9%. During the press conference, Powell duly noted that not a single member of the Fed expects a rate cut this year, and “it wouldn’t be appropriate.” As has been the case all year, the market refused to believe him or the Fed. The market FINALLY believed the Fed and pushed out its expectation for the first rate cut from November to January.

So What Did the Fed Say?

Powell’s introductory remarks were straightforward and introduced no surprises and no new themes. The Q&A during the press conference was a bit more interesting. Yet, it too failed to produce any big headlines. (Note quotes are from my notes during the live press conference and may be paraphrased. The Fed will post the full transcript in due time or check out the transcript available in the YouTube video).

Explaining the rationale behind keep rates steady, Powell stated that three significant factors influenced past decisions to increase rates: the speed of changes, the level at which rates are set, and the duration of restrictive tightening. With this latest decision, the focus has now shifted to considering the additional extent of tightening. He emphasized that the pace and level of tightening were separate factors and that the decision was only applicable for this meeting and did not hint at future approaches.

Some may question why the Fed would pause on raising rates, especially if economic projections seem to suggest the need for higher rates in the near future. Addressing this concern, Powell explained that slowing down the process as the Fed nears its rate target allows the economy more time to adapt. He said, “The question of speed is separate from level. As we get closer to the destination, it is reasonable to slow down.” For example, the Fed does not yet know the full consequences of the banking crisis.

Regarding a question about disinflation, despite stronger economic projections, Powell asserted that the committee has consistently maintained that the path downwards would be gradual. He pointed out that the supply needs to continue improving and that they were observing the earliest signs of disinflation, including wage costs.

One member of the press was surprised by what he called “hawkish sentiment” regarding future rate hikes. Powell explained that “forecasters have consistently thought inflation was about to turn down and have been wrong. Core PCE inflation over the last 6 months has not made progress.” He wants to see core PCE come down decisively, hopefully while doing “minimum damage” to the economy.

Powell acknowledged that understanding the lag effects of monetary policy is a challenging task. He dryly noted that there is research that gives any answer you like on lag effects. Yet “these days financial conditions tighten well ahead of actual tightening. Tightening happens much sooner than it used to.” The Fed’s transparency encourages the market to rush out to price in coming policy moves. He added that he “can’t point to an ultimate end point or data point. Ideally, by taking more time we won’t go well past the level we need to go.”

Addressing a question about the recent increase in Black unemployment rates, Powell acknowledged the concern and affirmed that it would be taken into account when considering maximum employment. He also acknowledged that while wages were not initially a significant concern, they were becoming more relevant to the discussion.

Finally, regarding systemic risk and potential effects of higher rates, Powell mentioned that the Federal Reserve was closely monitoring the commercial real estate situation. He concluded that if the tightening process were to generate risks, the Fed would take them into account for monetary policy. His claim sounded more reactive than I would expect given the recent collapses in regional banks.

Conclusion

The Federal Reserve’s decision to hold steady on interest rates is a strategic move aimed at allowing the economy to adapt to the changes already in motion. The July meeting is “live”, meaning that the Fed is open to hiking rates again if needed. Currently, the market has priced in a 65% chance of a July rate hike. The stock market performed pretty well given this refresh in hawkishness and the delay in timing for a rate cut. However, the extended time for better economic data also gives the summer of loving stocks room to grow. For now, I expect any near-term drawdowns to find support at the primary uptrends defined by 20-day moving averages on the S&P 500 and the NASDAQ.

Be careful out there!

Full disclosure: long QQQ call spread, long IWM call spread