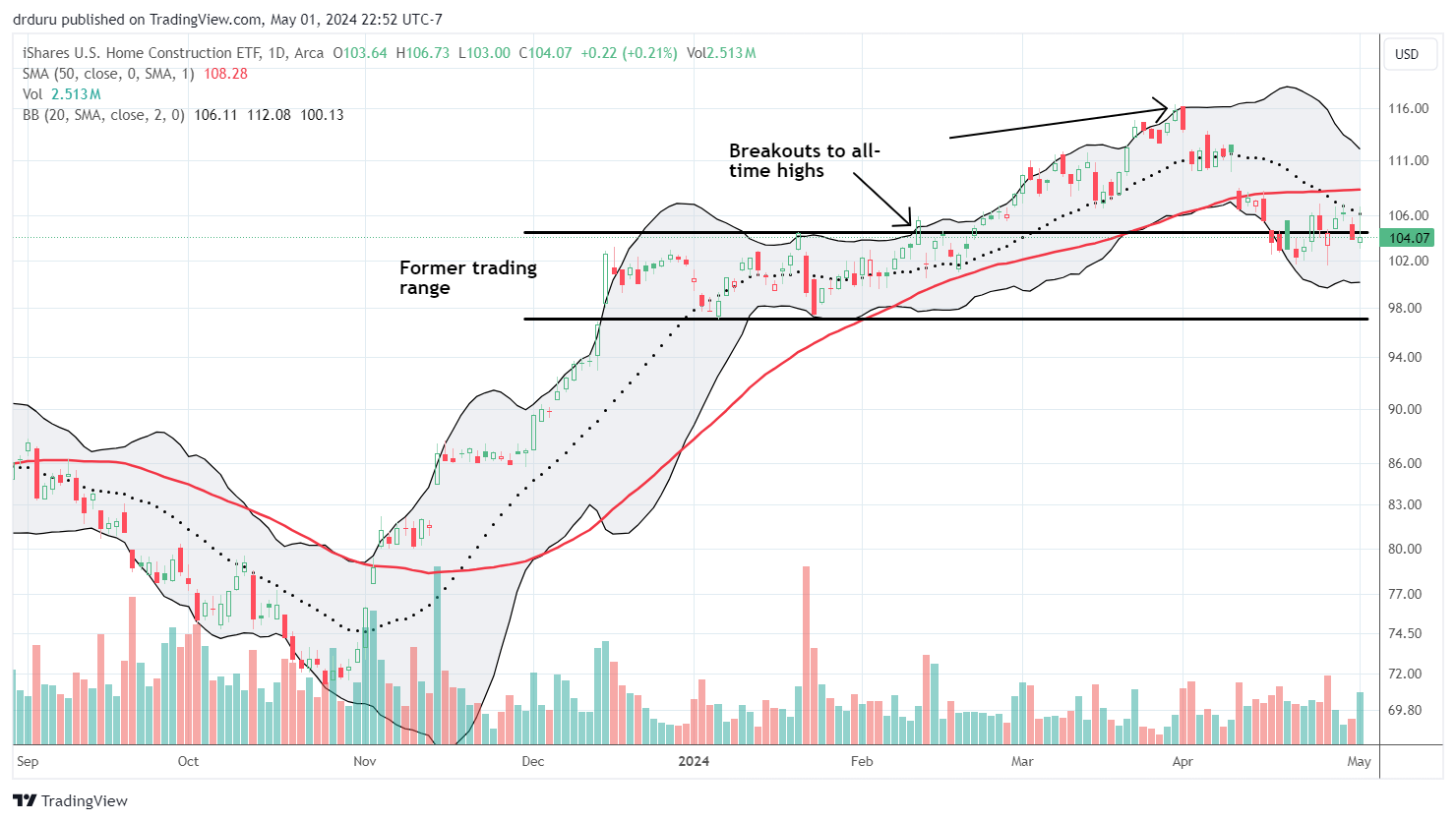

What Happened to the Housing Market – Stocks Topping and Sales Headwinds

Housing Market Intro and Summary What happened in the housing market in April, 2024? After four months of growing more positive, home builders proceeded into the spring selling season thanks to drag from the South. In my previous Housing Market Review, I pointed out a positive start to the spring selling season. April painted a … Read more