A Red Flag Pullback from the Edge of A Fresh Breakout – The Market Breadth

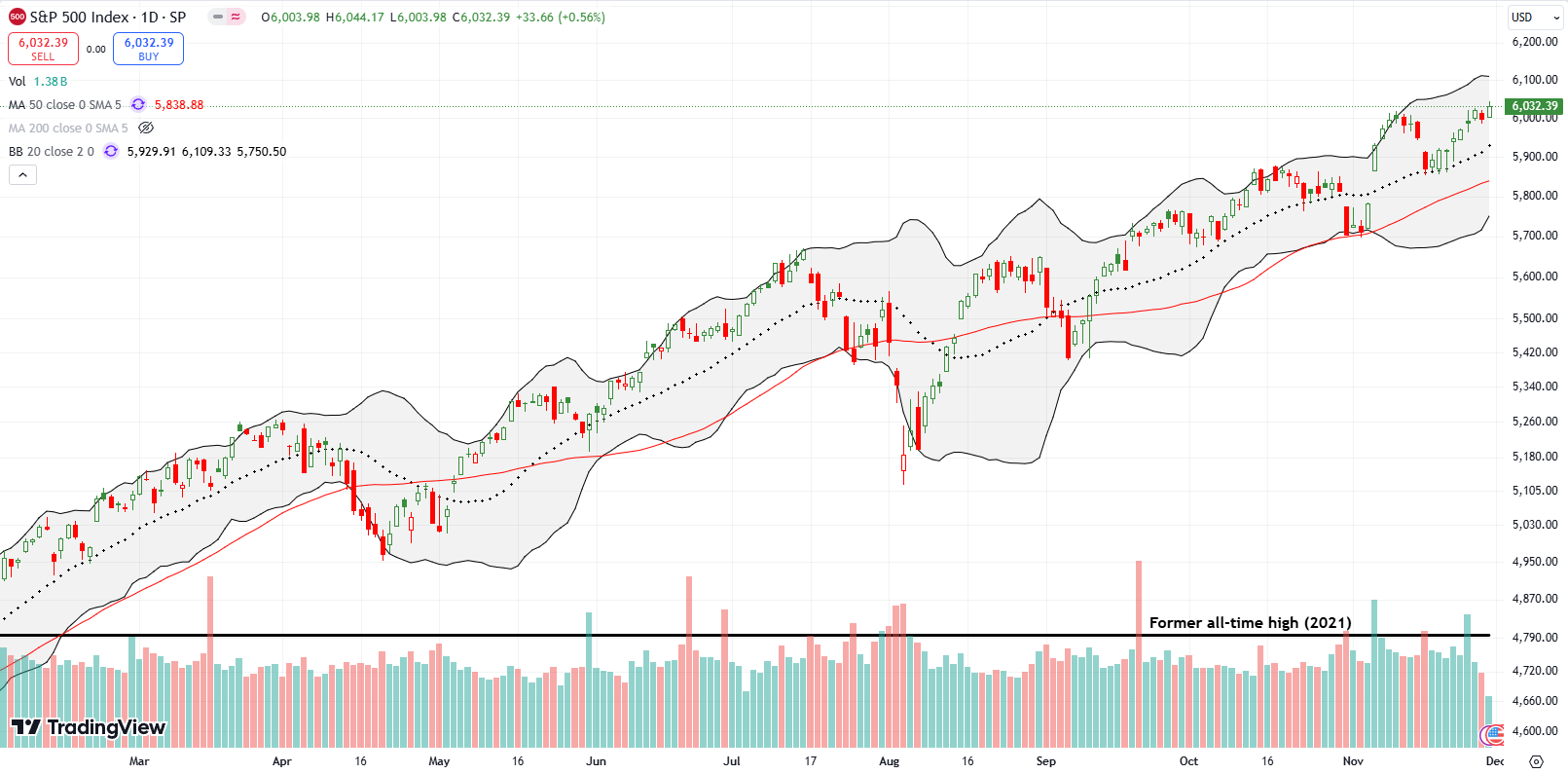

Stock Market Commentary The stock market looked ready to follow through on leaving its troubles behind. The S&P 500 even made a new all-time high. Everything seemed to fall apart on Friday. The final release of consumer expectations as measured by the University Michigan confirmed earlier preliminary numbers: inflation expectations soared and consumer sentiment tanked. … Read more