SearchGPT Shoves Google to A Footnote for the Generative AI Trade

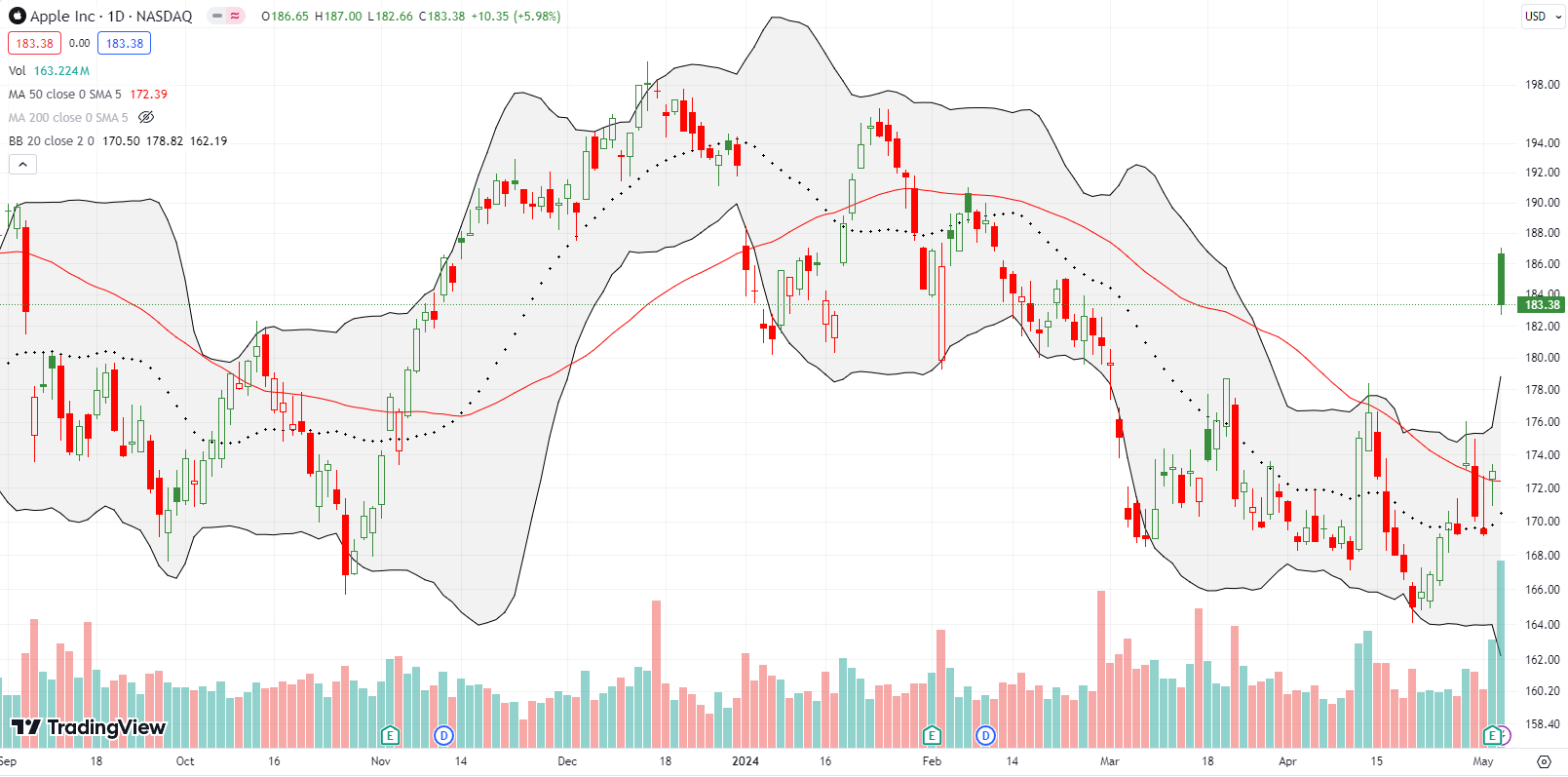

Alphabet, Inc (GOOG) was my favorite stock in my generative AI trade. No more. After OpenAI announced SearchGPT, GOOG fell 3.0%. The decline followed a 5.0% post-earnings loss and confirmed a bearish breakdown below the 50-day moving average (DMA) (the red line in the chart below). While SearchGPT is still a prototype, even the idea … Read more