Fades Press On Market Supports Ahead of the Election – The Market Breadth

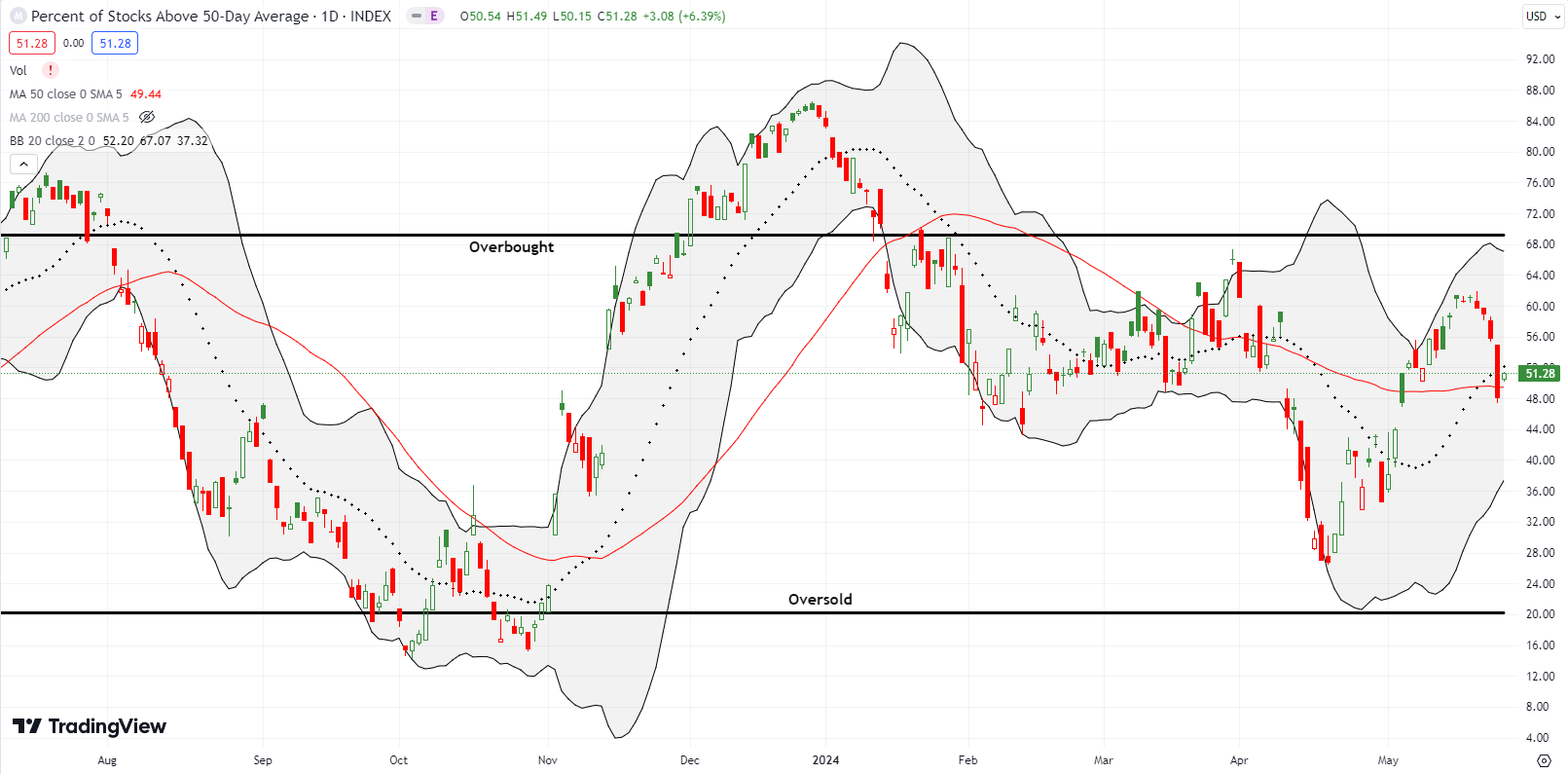

Stock Market Commentary Fades were on display, especially on Thursday, as the stock market showed signs of exhaustion. Bad news in and for the semiconductor industry seemed to motivate sellers. For example, earnings for Microsoft (MSFT) and Meta Platforms (META) seemed to release some steam on hyped expectations for the AI chips both companies will … Read more