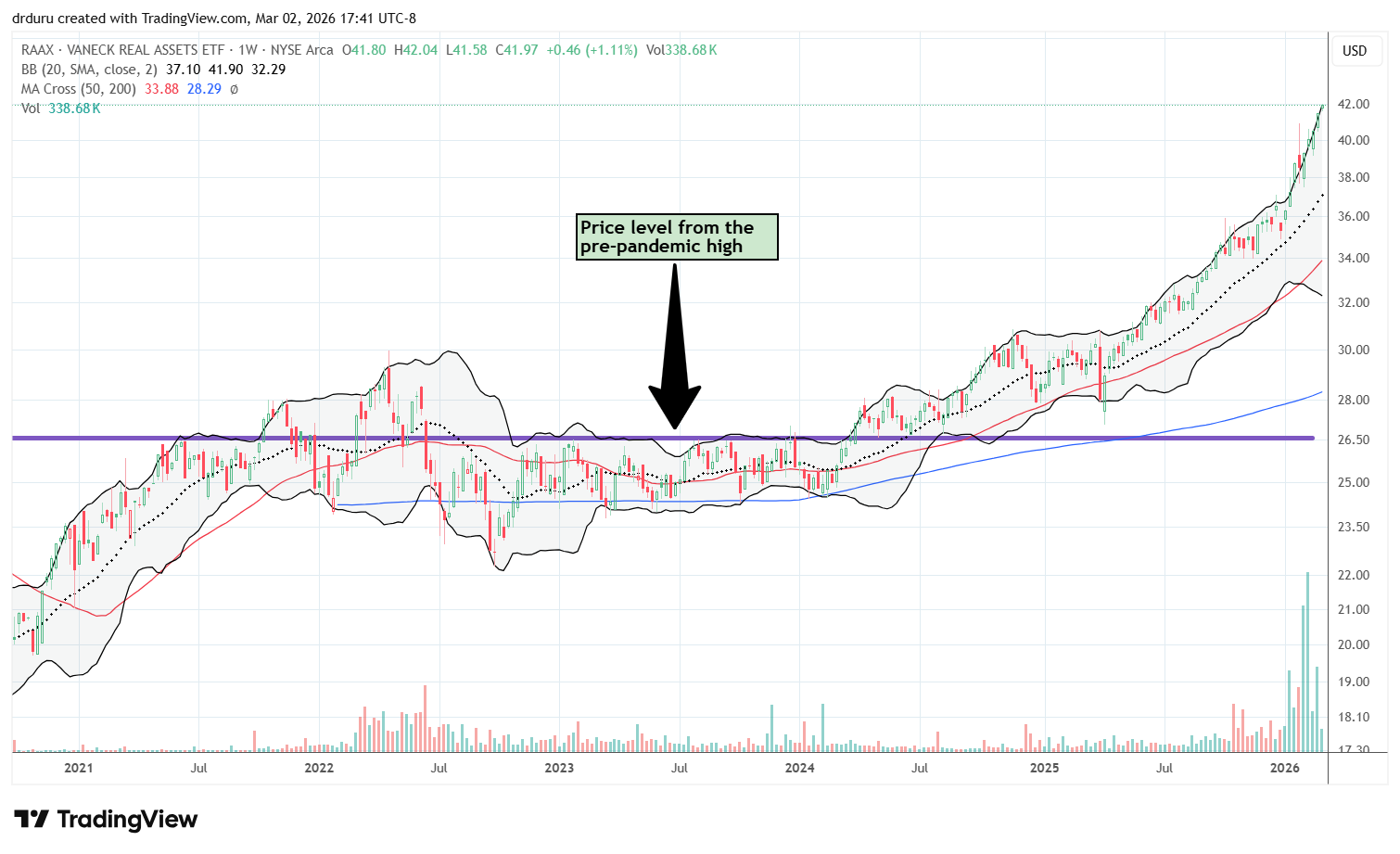

RAAX: A Real Assets Fund Speaking My Language

A Case for VanEck Real Assets ETF (RAAX) At the end of 2025 I made the case for buying commodities in 2026. I came into this year already owning a large, core basket of Rio Tinto (RIO), BHP Group (BHP), Freeport McMoran (FCX), and some rare earth stocks and looked forward to further growing these … Read more