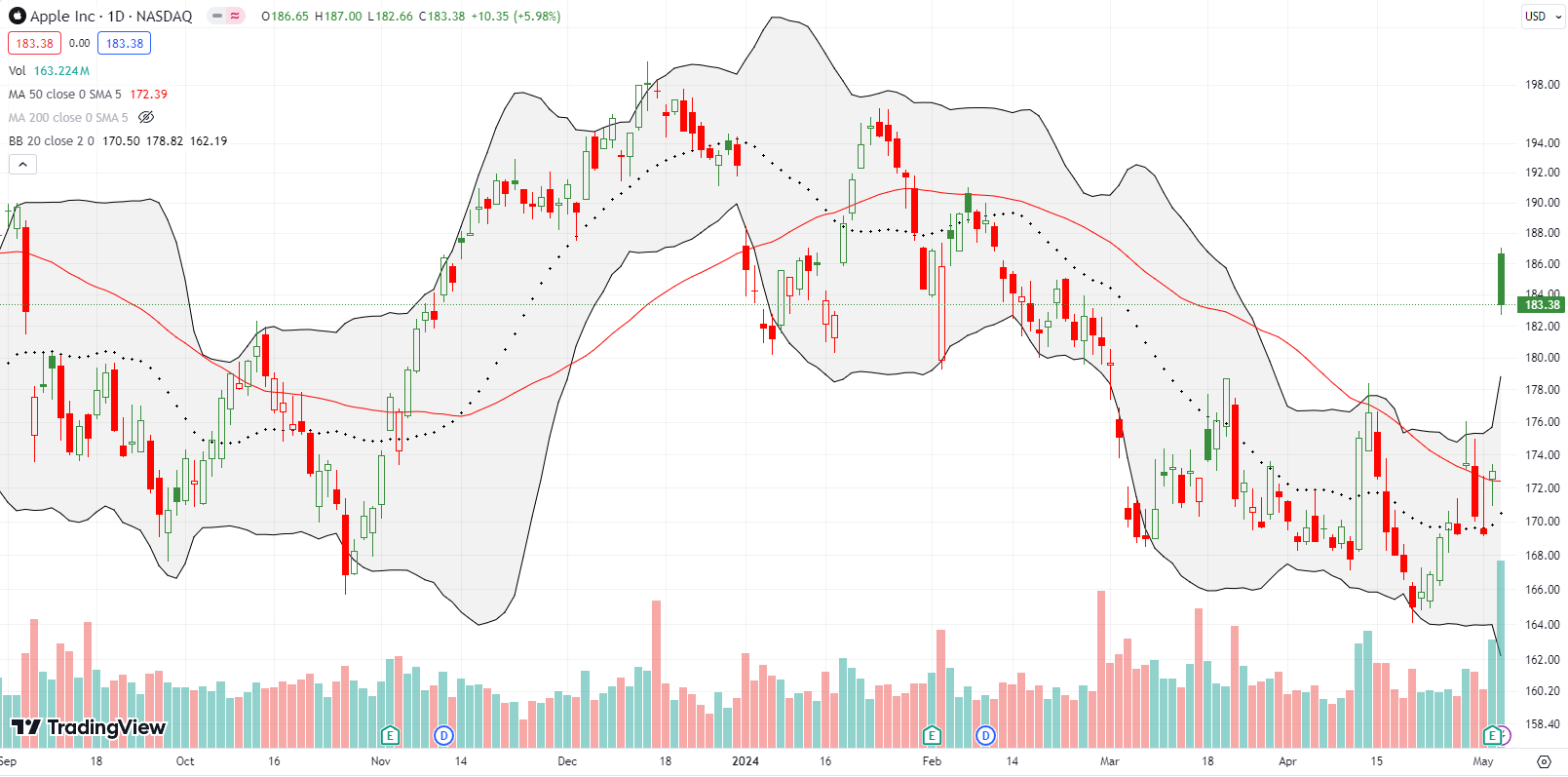

Semiconductor Setbacks Bolster Market Breadth – The Market Breadth

Stock Market Commentary The S&P 500 (SPY) is up 3.0% since summer trading began the day after the Memorial Day weekend. If not for the poor market breadth, the rally would look like a repeat of last year’s summer of loving stocks (sorry sell in May and go away folks). Semiconductor stocks, particularly NVIDIA Corporation … Read more