U.S. Dollar Wavers In the Wake Of Extended Fed Dovishness

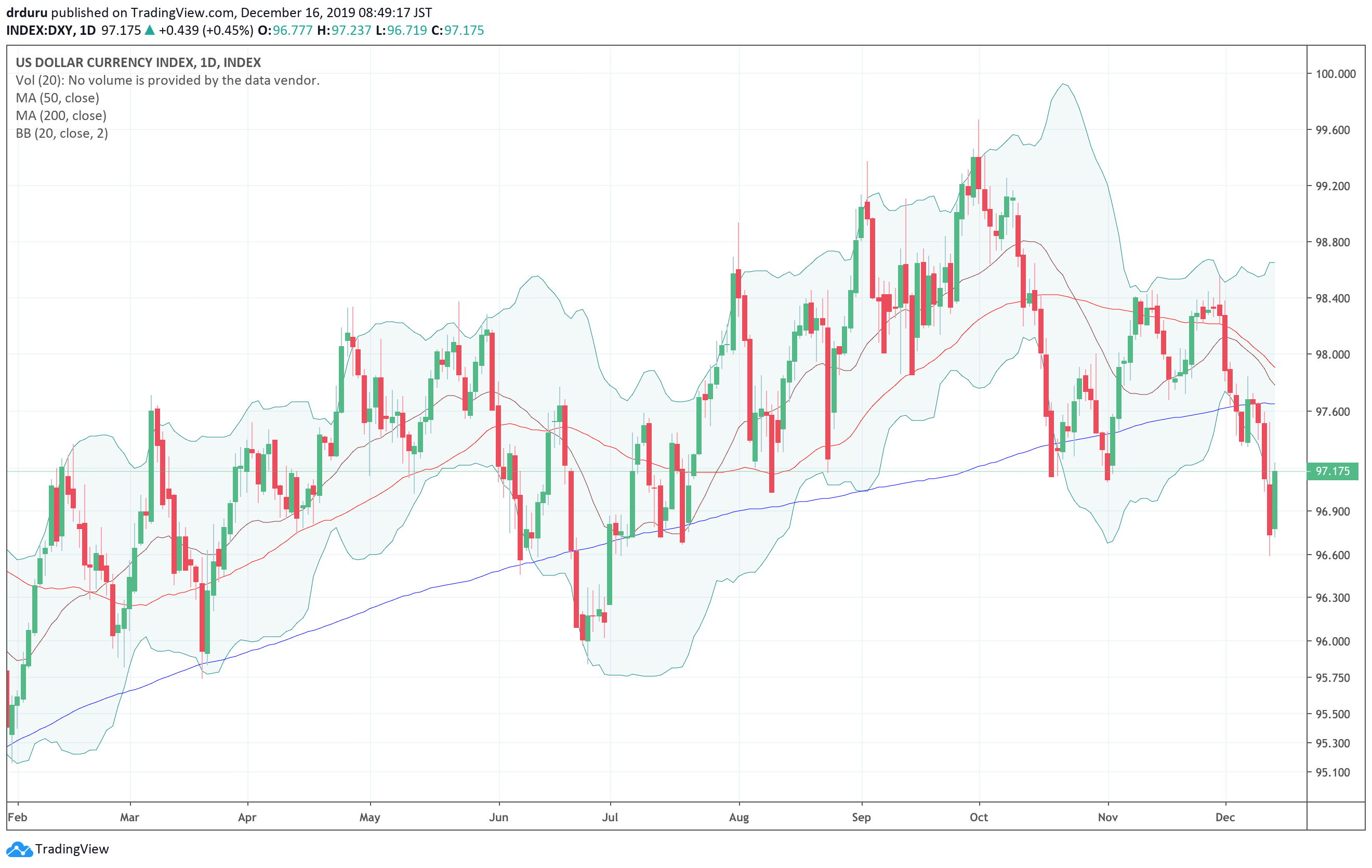

U.S. Dollar Breakdown In the wake of the Federal Reserve’s last pronouncements on monetary policy, the U.S. dollar index (DXY) sold off and confirmed its latest breakdown below its 200-day moving average (DMA). This latest 200DMA breakdown looks more damaging than other episodes. For example, the U.S. dollar index extended further below its 200DMA than … Read more