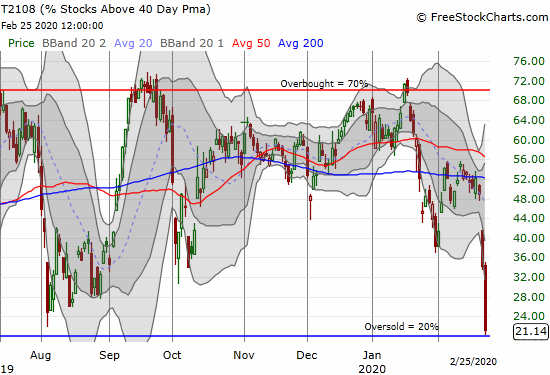

Suddenly Oversold: Stock Market Extremes Continue – Above the 40 (February 25, 2020)

AT40 = 21.1% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 39.6% of stocks are trading above their respective 200DMAs VIX = 27.9Short-term Trading Call: neutral Stock Market Commentary Synchronized breakdowns below the 50-day moving average (DMA) looked like an extreme day of selling. The follow-up was even more spectacular. … Read more