Stock Market Battle Royale: Regime Change Or A Big, Bad Bubble? – Above the 40 (January 26, 2021)

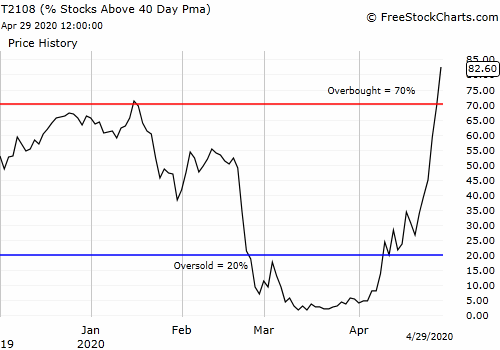

Stock Market Commentary After the stock market ended its last overbought period, I hesitated to drop my short-term trading call back to bearish. Three days later and the market has yet to snap back into overbought trading conditions. As the major indices levitate, my favorite breadth indicator, AT40 (T2108), the percentage of stocks trading above … Read more