A Tech Stock Breakdown While Rest of Market Yawns – Above the 40 (September 18, 2020)

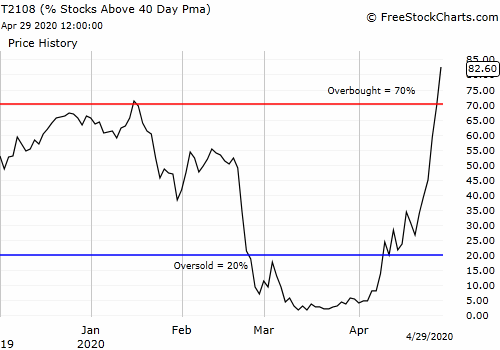

Stock Market Statistics AT40 = 43.5% of stocks are trading above their respective 40-day moving averages (DMAs)AT200 = 44.9% of stocks are trading above their respective 200DMAsVIX = 25.8Short-term Trading Call: cautiously bearish Stock Market Commentary Tech stocks led the way up, and now they are leading the way down. The top 1% of the … Read more