Market Crash 2020 Addendum

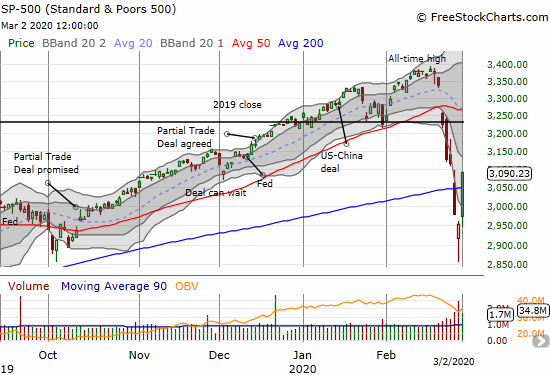

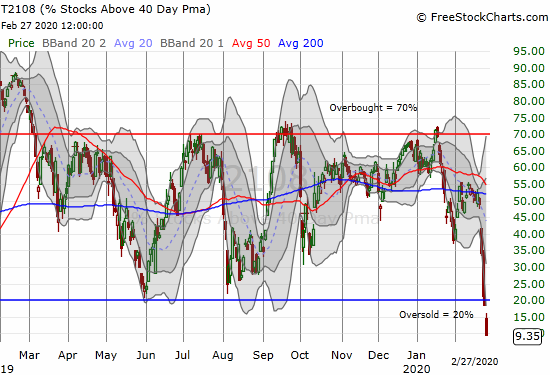

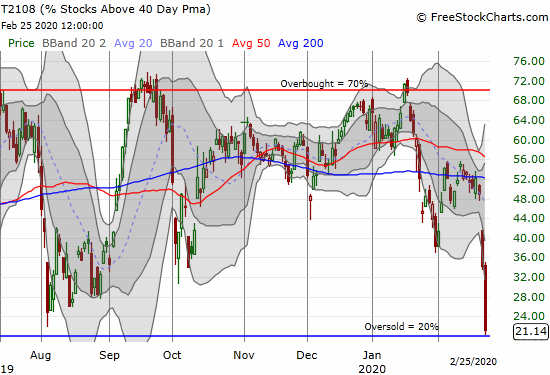

This post is a quick addendum to the Above the 40 post I published just ahead of a complete freefall in global financial markets. At the time of writing, futures are showing a 5% drop in the S&P 500 (SPY)! The crash is reflected in real-time in the currency markets. I actively watch the Australian … Read more