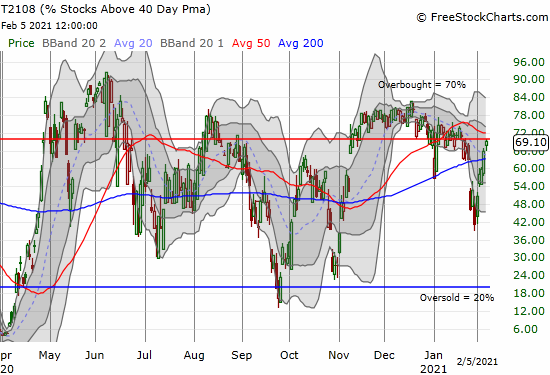

Tricky Trading Quickly Took Stocks from Strength to Weakness – Above the 40 (February 26, 2021)

Stock Market Commentary The stock market got quite tricky last week. A day after buyers re-established control, sellers returned with a sustained fury. The selling on Thursday reflected the stock market’s split personality while the follow-up selling on Friday seemed broader. The pressure on the the stock market looks like an ominous setup for March … Read more