Stocks Stumbling With Looming Oversold Conditions – The Market Breadth

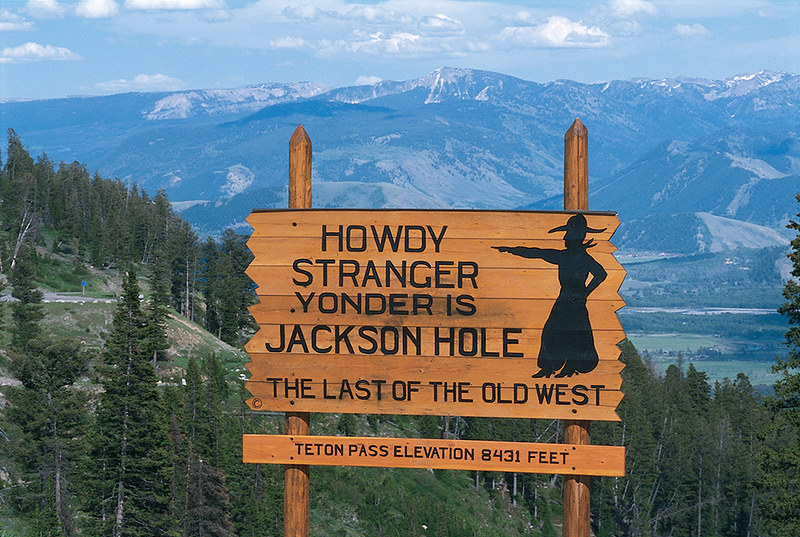

Stock Market Commentary Stocks stumbled their way through a week fraught with hopes and fears for Fed Chair Jerome Powell’s speech at Jackson Hole. With looming oversold conditions, the most significant technical event occurred with a bearish engulfing right under important resistance levels for both the S&P 500 and the NASDAQ. The relief buying that … Read more