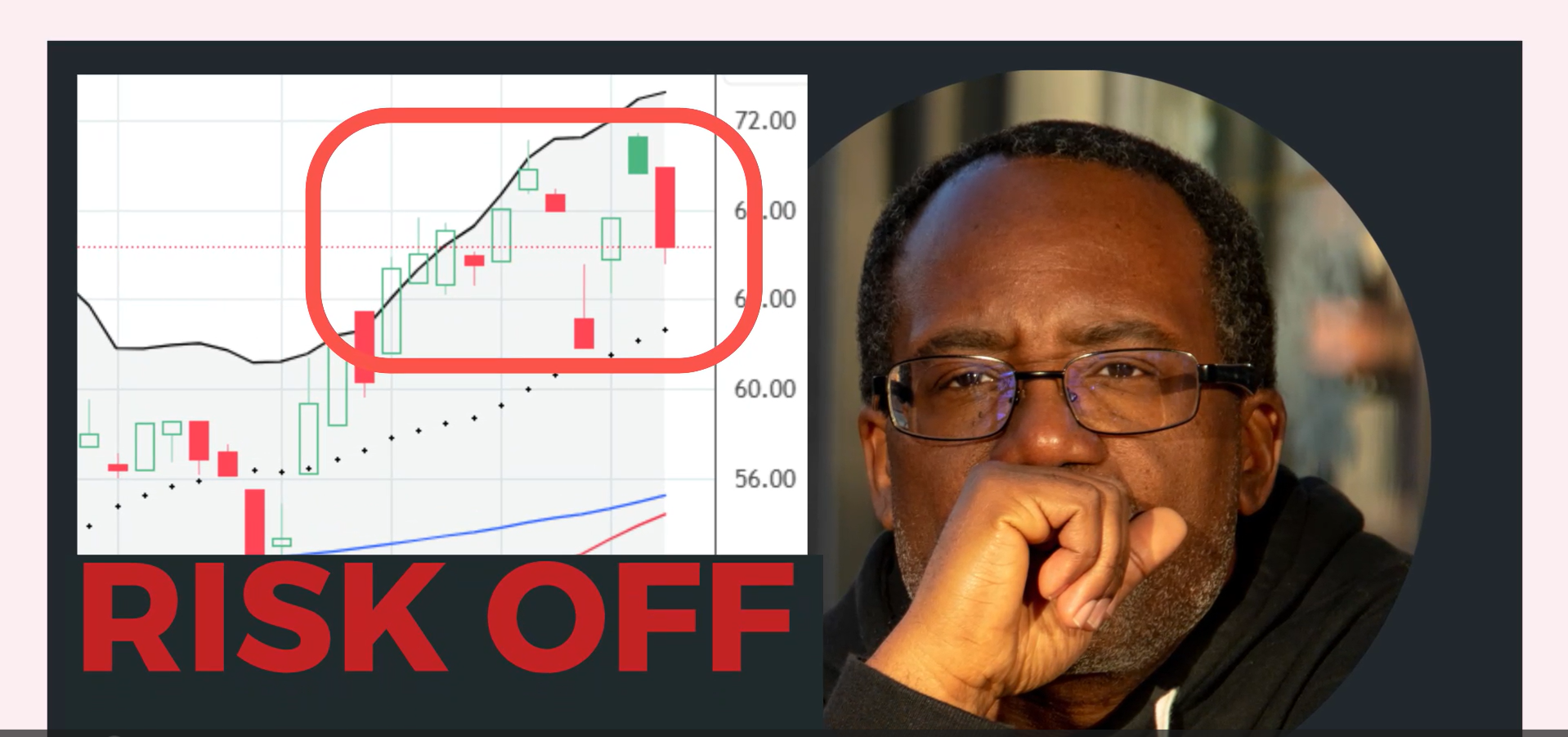

Bearish Market Breadth + Earnings Season = Risk Off (The Market Breadth)

The Market Breadth Summary Stock Market Commentary I am risk off in the coming week because market breadth failed twice at the overbought level. One failure is enough to make me cautious, but two tells me that the market is fighting too hard just to go higher. Moreover, earnings season is in full swing. For … Read more