Stock Market Buyers Counter Sellers With Their Own Line in the Sand – Above the 40 (May 15, 2020)

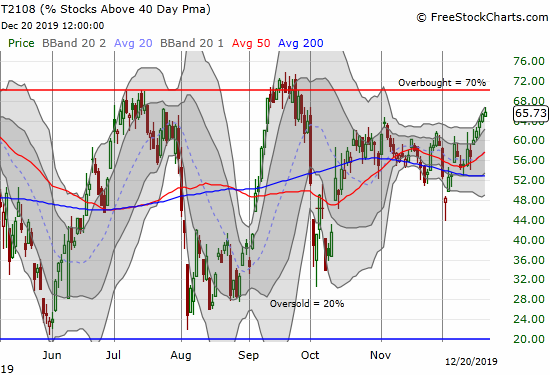

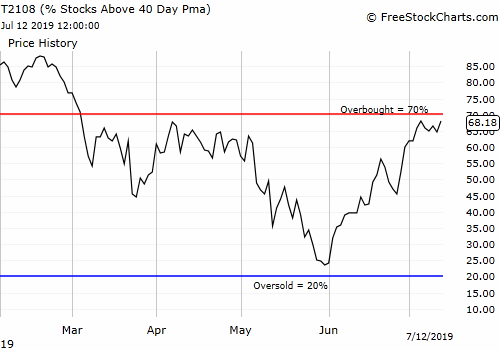

Stock Market Statistics AT40 = 56.6% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 14.5% of stocks are trading above their respective 200DMAsVIX = 31.9Short-term Trading Call: neutral Stock Market Commentary The week began with sellers finally drawing a line in the sand. The week ended with a counter from … Read more