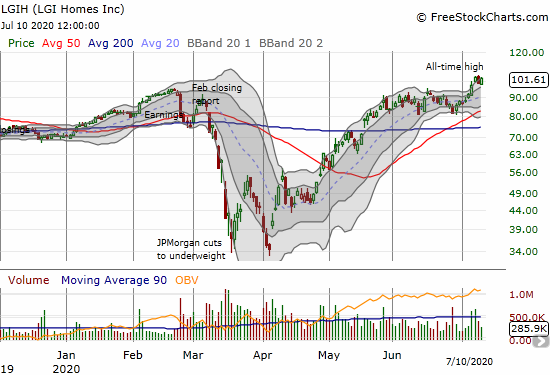

LGI Homes: Stock All-Time Highs As Business Races Past COVID-19 Woes

Look no further than LGI Homes (LGIH) as a confirmation that at least some parts of the country are back to business after a temporary pause from COVID-19 (coronavirus) economic woes. Last week, LGI Homes reported more astounding sales results. From the press release: June home closings: +16.7% year-over-year Q2 home closings: +3.1% year-over-year, the … Read more