Bearish Divergence Going Into Seasonally Weak Months – But Does It Matter? – The Market Breadth

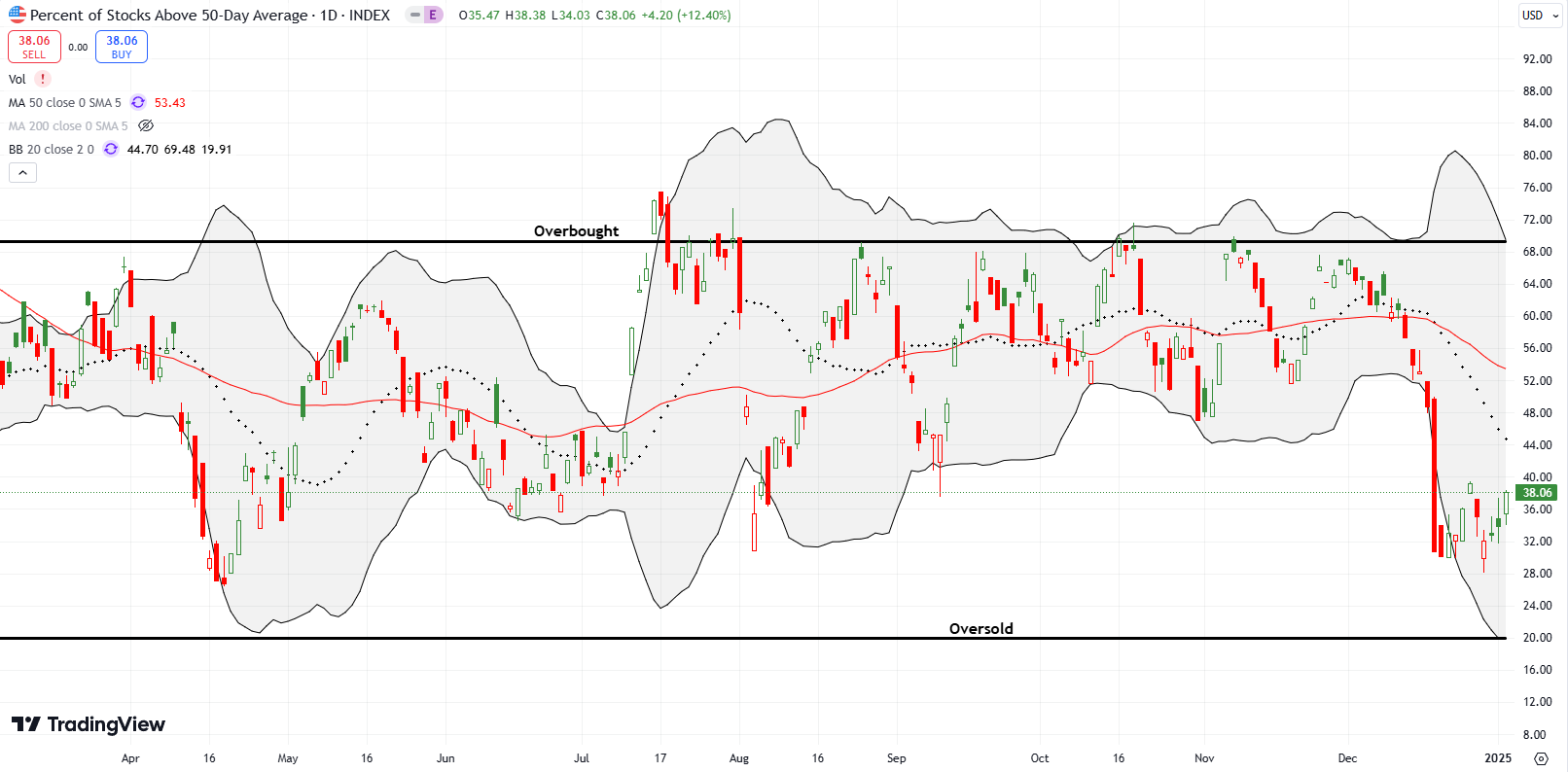

Stock Market Commentary A bearish engulfing top pattern in the S&P 500 now seems like a distant memory. Yet, the melt-up in the stock market faces a new test. Just as the stock market enters its most dangerous months of the year in terms of drawdowns, a bearish divergence has emerged with market breadth. What … Read more