How to Invest in the Soaring Rate of U.S. Homeownership

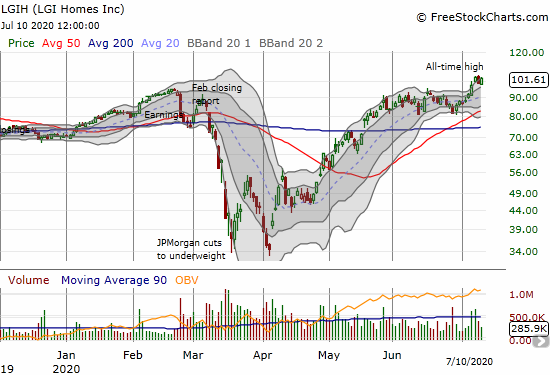

Accelerating Homeownership Rates The coronavirus pandemic has accelerated many trends that were underway going into 2020. Rising homeownership rates in the U.S. hopped onto the trend. Source: U.S. Census Bureau, Homeownership Rate for the United States [RSAHORUSQ156S], retrieved from FRED, Federal Reserve Bank of St. Louis; July 29, 2020. The above (adjustable) graph shows the … Read more