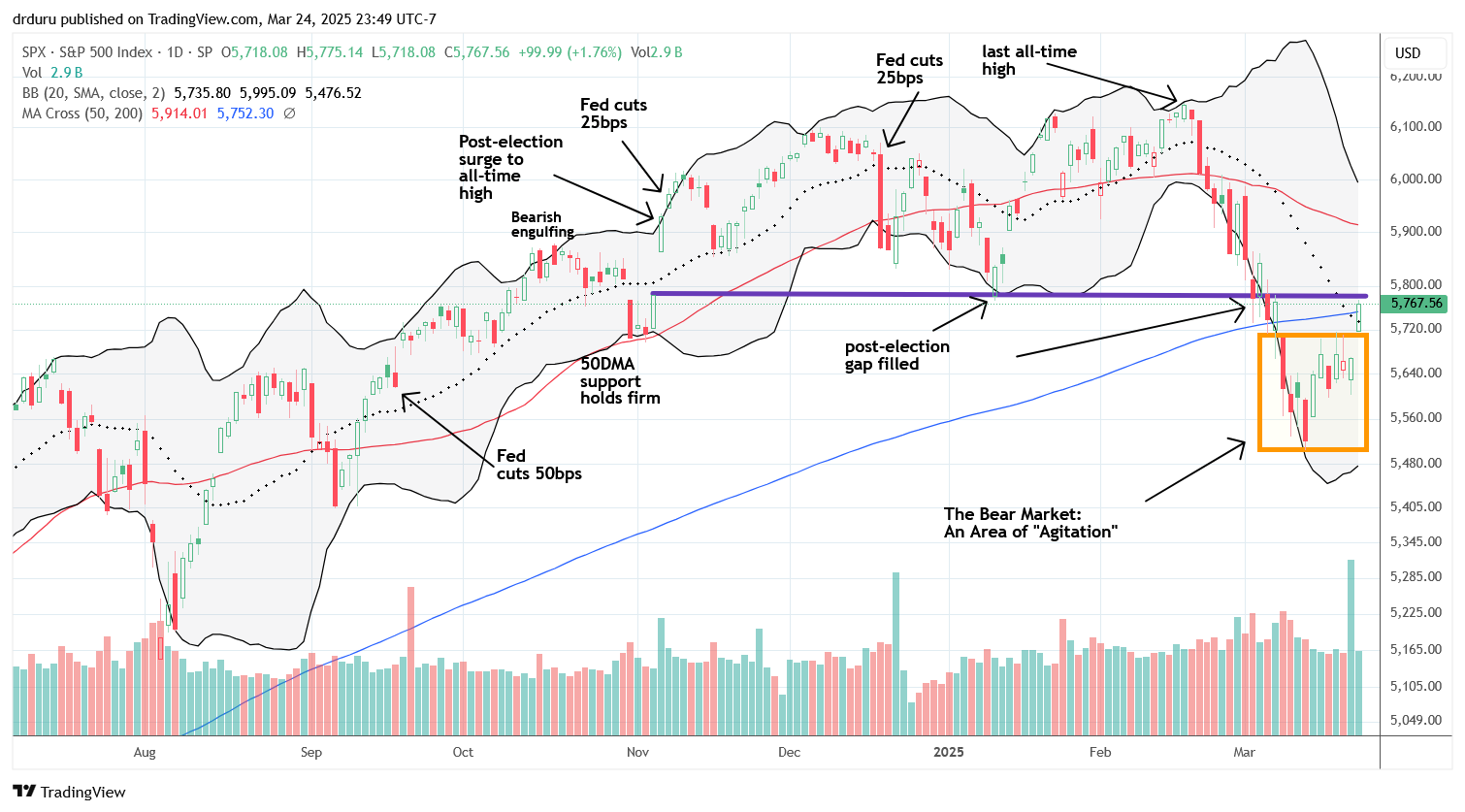

A Strong Week After Tariff Rumors and Relief – The Market Breadth

Stock Market Commentary The tariff rumors proved true after all. The green shoots of Monday that grew alongside the rumor of a pause presaged Wednesday’s massive relief from a real blink on tariffs. Those historic gains were large enough to generate a strong week broadly across the stock market. Still, as more blinking and backing … Read more