A Market Breadth Breakdown Belies Tech Strength – The Market Breadth

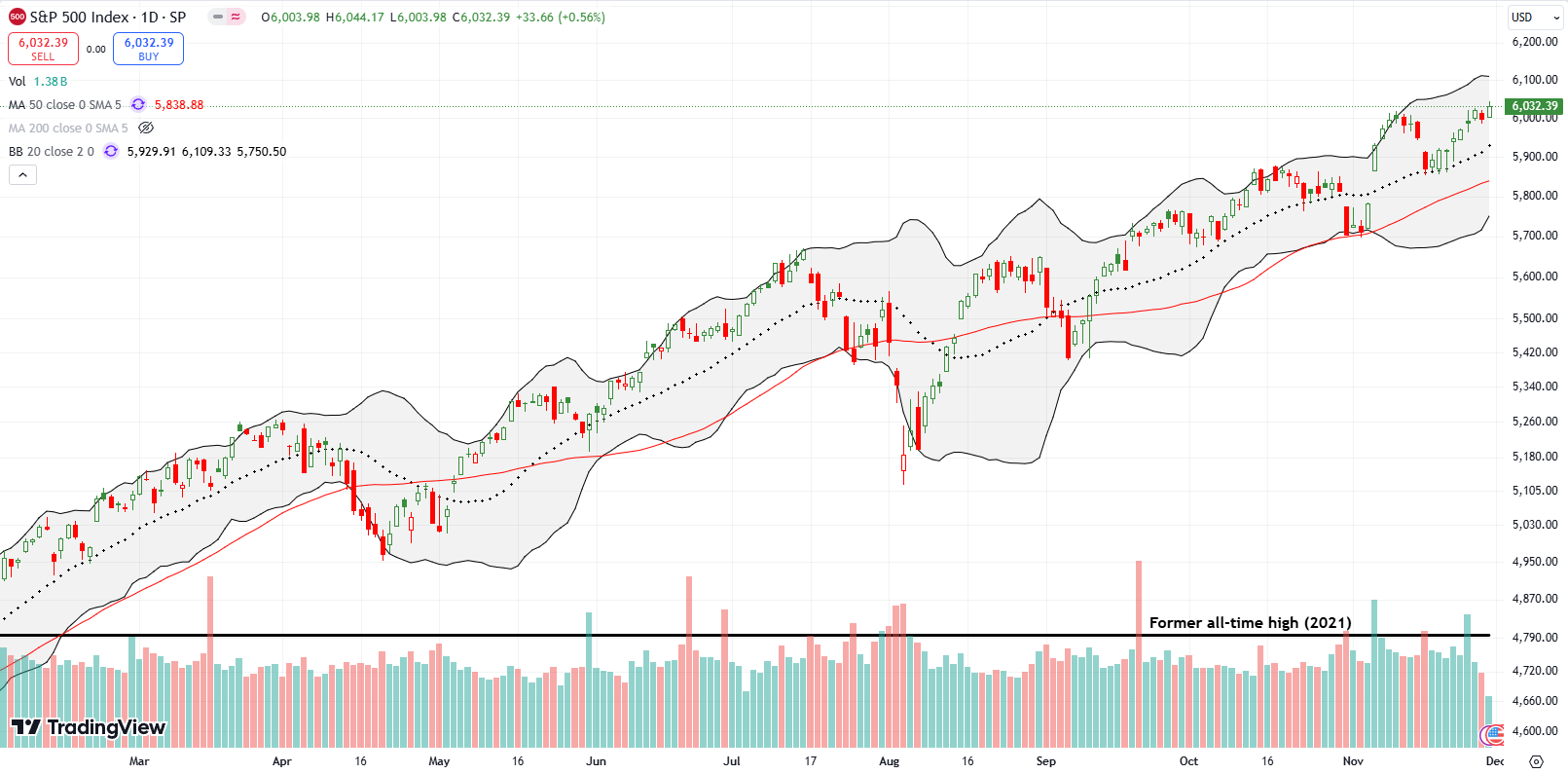

Stock Market Commentary Inflation was the big story last week. I covered the details in “Bonds Try to Weigh on A Market Trying Harder to Look Past Stabilizing Inflation“. The stock market had a curiously mixed reaction that highlighted an on-going bearish divergence for the month of December. A market breadth breakdown contradicted impressive strength … Read more