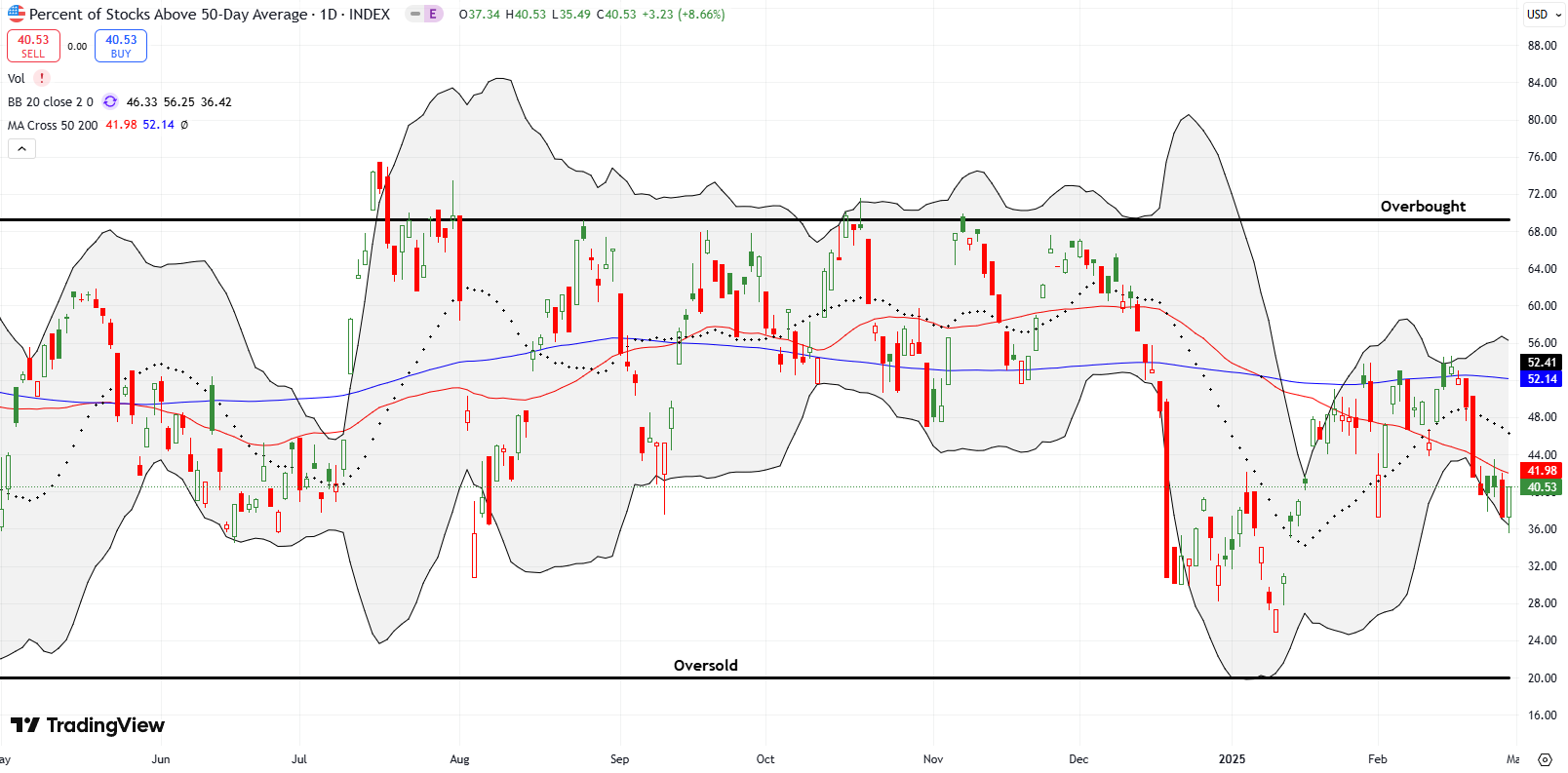

Overdue Relief Comes to the Stock Market – The Market Breadth

Stock Market Commentary Last week marked an important shift as the stock market experienced overdue relief. Most notably, there were no major headlines causing significant disruptions in financial markets. Instead, the market continued the theme of recovery from the previous week, driven by policymakers pivoting their messaging about the economic chaos triggered by policies and … Read more