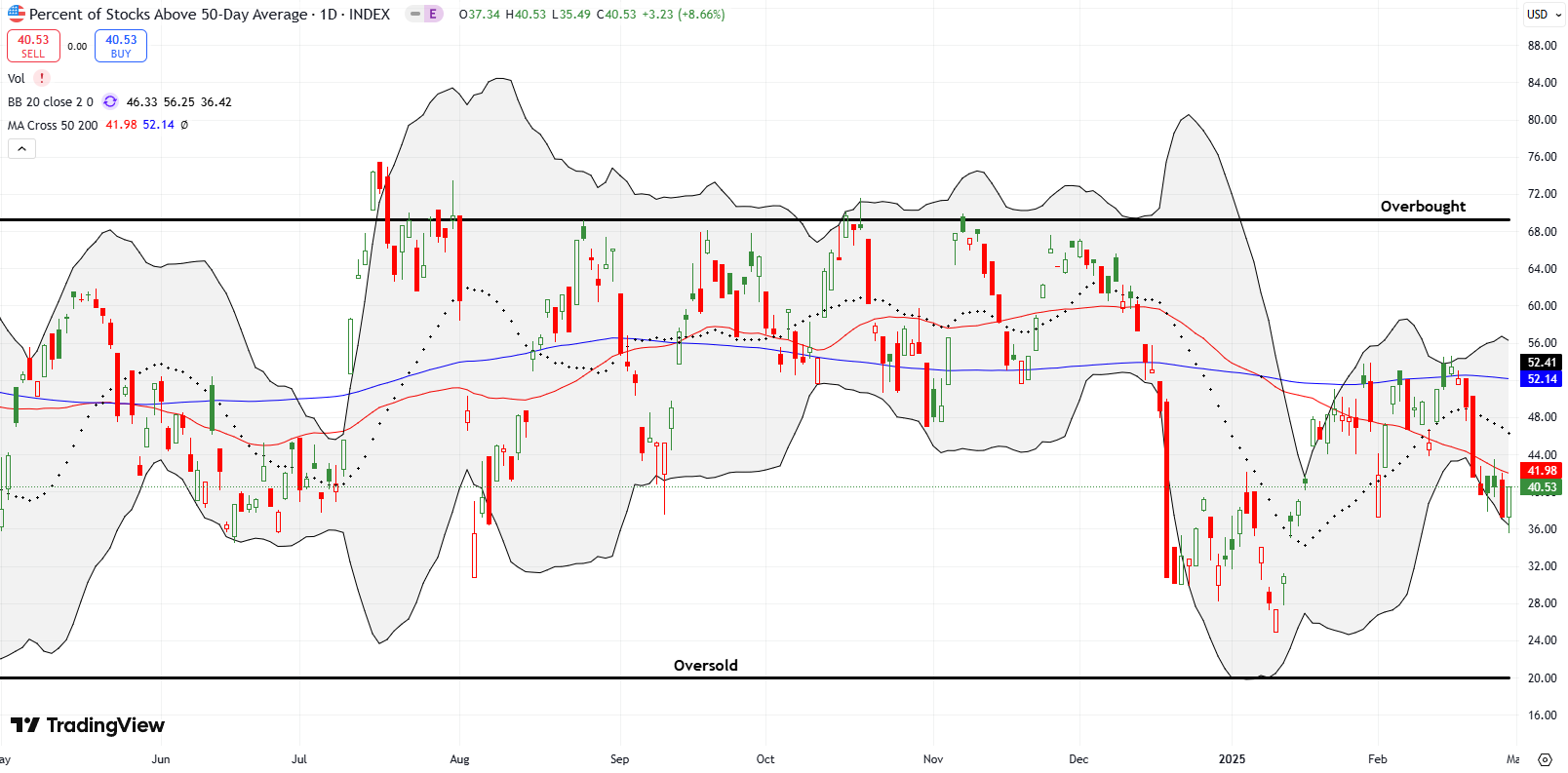

Not Oversold Enough for My Taste – The Market Breadth

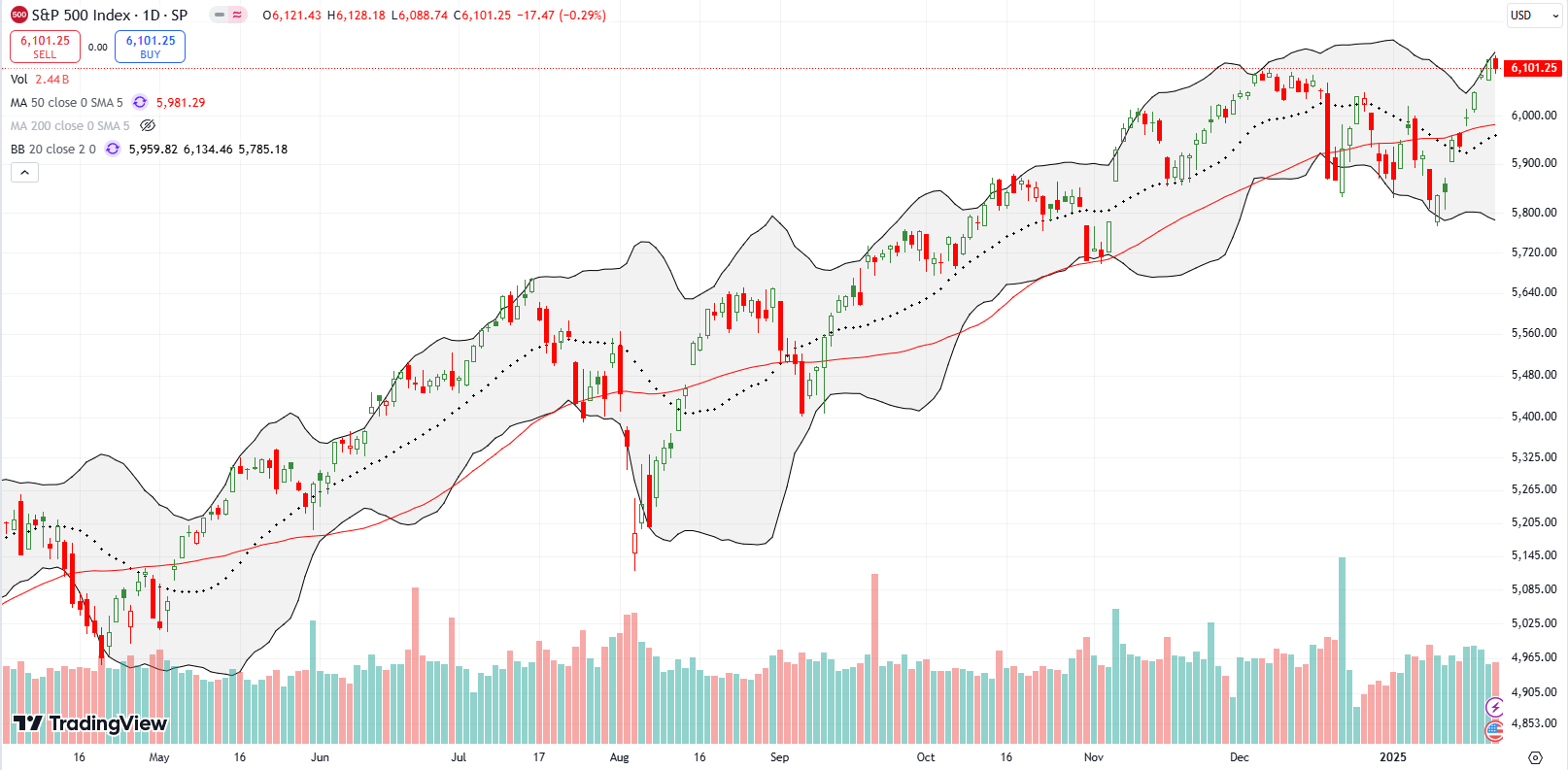

Stock Market Commentary Stock market angst reached a kind of crescendo last week. Poor economic data and bad news – including a plunge in consumer confidence, a 180 degree reversal in the Atlanta Fed’s Q1 GDP growth projection from +2.3% to -1.5%, risk-off trading in cryptocurrencies (apparently due to a massive hack of ByBit), and … Read more