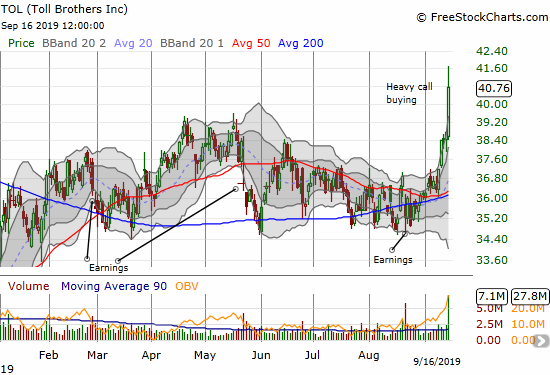

The Message in Toll Brothers

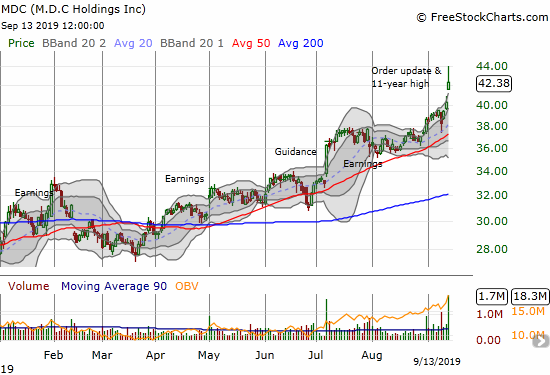

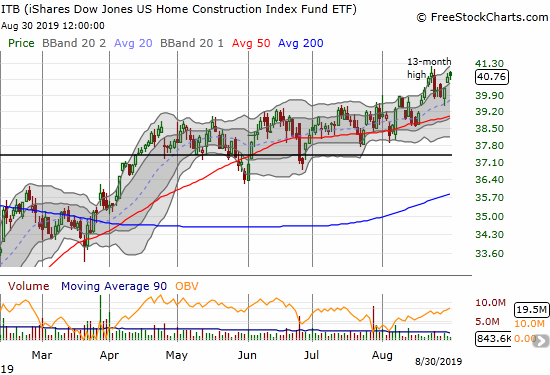

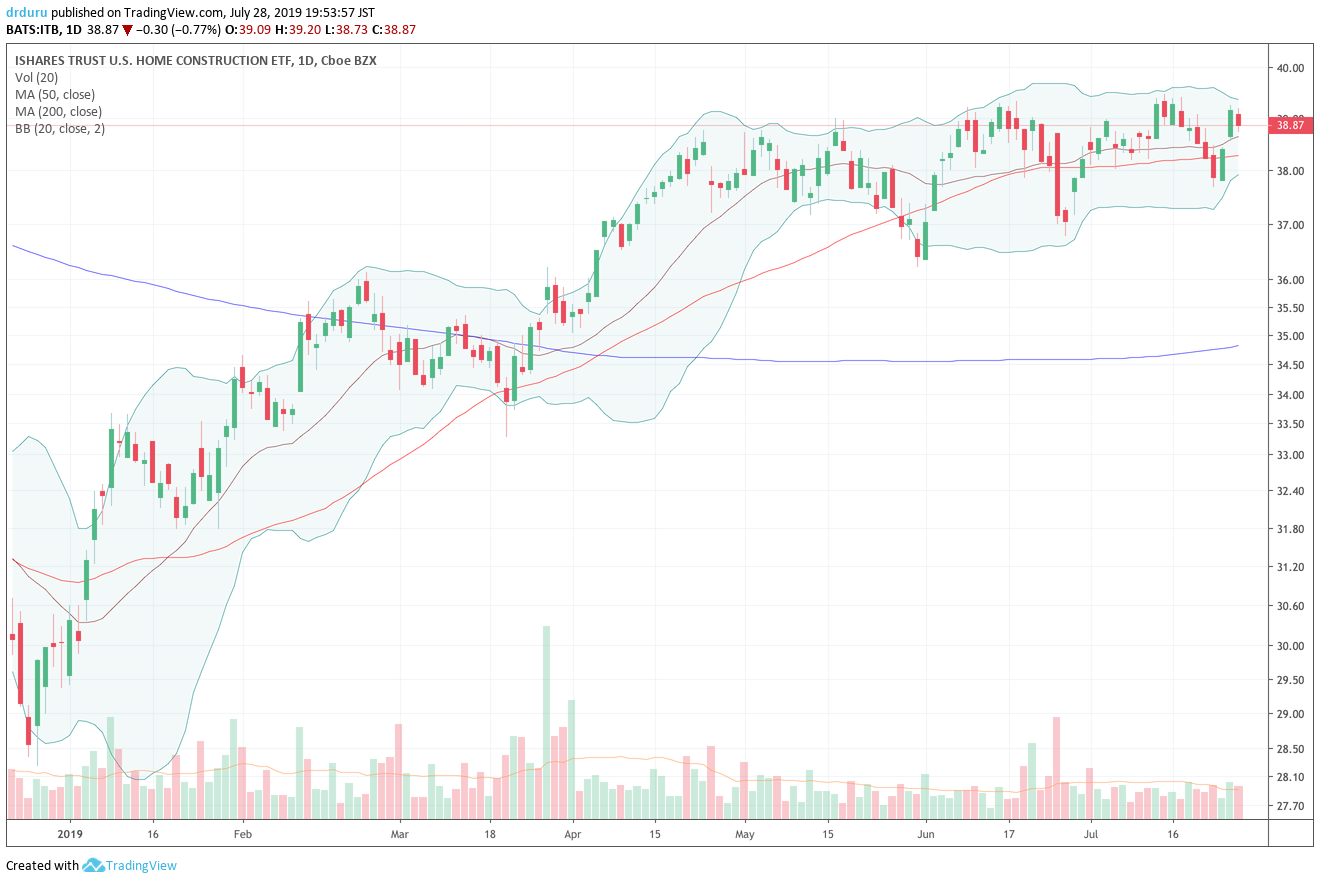

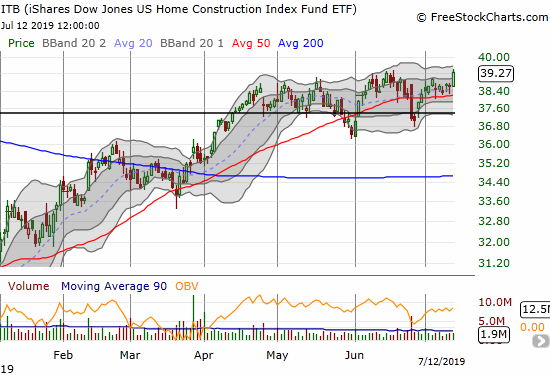

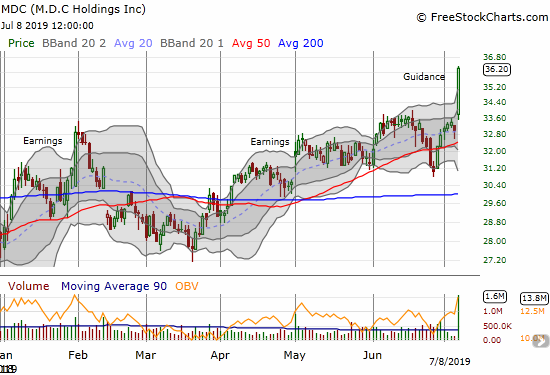

The Pairs Trade Exactly one month ago, I pointed to a pairs trade using put options in Toll Brothers (TOL) and call options on the iShares Dow Jones Home Construction ETF (ITB). Home builders selling affordable and otherwise lower-priced homes were rapidly gaining favor. Toll Brothers, a builder of luxury, high-end homes, was greatly under-performing … Read more