Overall Assessment

The stocks of home builders have had a banner year. The failure of the iShares Dow Jones Home Construction ETF (ITB) right at the climactic high of January, 2018 exposed a change in sentiment at an important juncture. So far, M.D.C Holdings (MDC) has suffered one of the most damaging changes in sentiment. MDC led the big breakout of home builders over the summer, so the extremely poor response to Q3 earnings makes me a lot more wary than normal for this seasonally strong period for home builders.

The following quote from the earnings conference call summarized well a fundamental problem with the earnings report from M.D.C. Holdings: “our top and bottom line results have not yet seen the full benefit from our success.” This observation is a truth wrapped up in a contradiction: the prime measures of success ARE revenue and profits. So if those measures come up short, it makes sense to conclude something is wrong with the company. In other words, if the company cannot translate “success” into positive financial measures, then the company must be at risk of worsening results. These risks are particularly acute when the bullish housing cycle is as old as it is with every home builder now chasing down the same formula for success with entry-level buyers and affordable price points.

The company’s Q3 2019 earnings report was two sided. On the one hand was a bullish management celebrating strong growth and promise in its backlog. On the other hand was the stark reality of declines in revenue and profit. Even the story on pricing was not consistent. M.D.C. Holdings touted its strength in delivering affordable housing, yet the company pushed through small price increases across most of its communities…and somehow average selling prices still declined. All things considered, investors understandably headed for the exits on this news.

Stock Performance

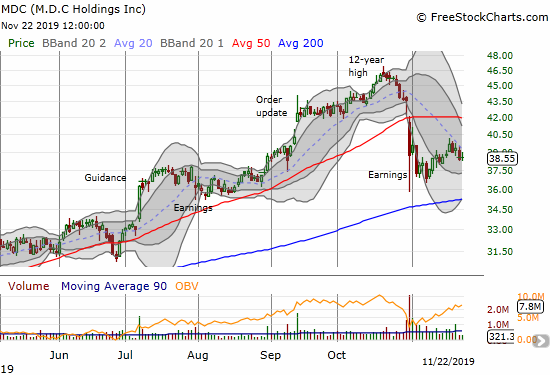

M.D.C. Holdings (MDC) dropped as much as an astounding 17.9% before rebounding to an 11.2% post-earnings loss. The ferocity of the selling was particularly unsettling since all year investors have tended to give most home builders the benefit of the doubt. I believe this post-earnings loss was the largest in years across the sector. The drop was steep enough at the intraday lows to reverse all of MDC’s incremental gains from the big summer breakout in July. I was too slow to try to buy into the stock at that point as part of the seasonal trade on home builders, but I did buy call options and shares into the subsequent selling. I flipped the shares into the eventual post-earnings relief rally and am still holding the call options.

I am waiting to see how the stock resolves the technical squeeze between overhead resistance from the 50-day moving average (DMA) and support at the 200DMA. MDC’s valuation is low, but the price/book ratio is on the higher end of most builders. The stock could remain stuck in this limbo until the next catalyst.

MDC’s implosion came just one day after a post-earnings breakdown in fellow medium-sized builder Century Communities (CCS). This combination makes the sentiment shift look all the more ominous. While CCS is still out-performing ITB this year, MDC is now under-performing.

- One day after reporting Q3 2019 earnings: -11.2%

- Since the close after Q3 2018 earnings: +33.1%

- Since the close after Q3 2019 earnings: -0.4%

- For the year until the close before earnings: +37.7%; compare to +48.6% for the iShares Dow Jones US Home Construction ETF (ITB)

Valuation (from Yahoo Finance)

- 12-month trailing P/E: 12.2

- 12-month forward P/E: 9.4

- Price/book: 1.4

- Price/sales: 0.8

- Short % of float: 4.8%

Year-Over-Year Performance (3 months ended September 30, 2019 and quarter-ending values)

- Home sales revenue: -2.0%

- Unit deliveries: +8%

- Unit net orders: +58%

- Average selling price: -9%

- Average selling price of net orders: -5%

- Net income: -5.2%

- Gross margin from home sales: from 17.7% to 18.8%

- Earnings per diluted share: -8.1%

- Ending backlog value: +16% (highest since 2006)

- Cash and cash equivalents: -20.9%

- Ratio of net debt to capital: N/A

- Closings from “more affordable offerings”: from 49% to 62%

Year-Over-Year Performance (9 months ended September 30, 2019)

- Home sales revenue: +0%

- Unit deliveries: N/A

- Average selling price: N/A

- Net income: -6.6%

- Earnings per diluted share: -9.1%

Year-Over-Year Guidance and targets for 4th quarter

- Q4 home sales revenue: over $1B (first time this high since 2006)

- Community count growth: +10% for the year

- “…a significant year-over -year increase in the number of net new orders in October versus a year ago.”

- Backlog conversion ratio: +50%

- Average selling price: -4.2%

- $2.1B backlog is highest in value since 2006 and supports projections for “significant” year-over-year jumps in revenue and earnings

Highlights from the Earnings Call

Market Conditions and Characteristics of Demand

- “The order of momentum we experienced earlier this year carried into late summer and early fall.”

- “…we continue to see relatively better sales activity [at our] more affordable price communities as compared to our higher price communities. This trend is fairly consistent across our footprint and shows no signs of slowing down.” This characterization means that the lower-priced market is going to make or break the overall housing industry in the foreseeable future.

- “The demand for a more affordable product lines remain strong during the…third quarter of 2019, accounting for 60% of our net new orders compared to 54% a year ago.”

- The 3.6 absorption pace was MDC’s highest for a third quarter since 2005.

- As a further sign of confidence, MDC ended three straight quarters of year-over-year declines in lot approvals. Lots approved is almost at a 10-year high.

Regional housing markets

- Phoenix was a stand-out given its affordability profile.

- California is a “bit softer” given the expensive profile.

Pricing Power

- “…implemented price increases at most of our active communities in an effort to better maximize the profit for homes sold”. MDC insisted the resulting drop in absorptions was still seasonally strong.

- Increased price in about 80% of communities at a 1% average – despite going after the affordable segment of the housing market.

Margins and Costs

- Backlog margins are “slightly better” than current margins

Final Observations

M.D.C. Holdings is laying claim to strong sales activity going forward. The current revenue and profit numbers demonstrate that prior sales strength did not deliver the expected or desired financial results. This kind of shortcoming was something I feared when MDC surprised the market earlier with pre-earnings guidance of strong order activity. Now investors will be wary: did MDC price its backlog too low? Are high absorpptions indicative of missed opportunities? Did MDC move too slowly to turn the corner of approving lots?MDC’s next report on orders should deliver a very telling challenge to investor sentiment.

Earnings sources

- 2019 3rd quarter results: October 30, 2019

- 2019 2nd quarter results: July 31, 2019

- 2018 4th quarter results: January 31, 2019

- 2018 3rd quarter results: November 1, 2018

- Seeking Alpha Transcripts: M.D.C. Holdings, Inc. (MDC) CEO Larry Mizel on Q3 2019 Results – Earnings Call Transcript

Be careful out there!

Full disclosure: long MDC calls, long ITB calendar call spread

Seems to me there’s just one possible explanation that aligns with everything management did and didn’t say (at least, as quoted in your summary): their costs (labor and/or raw materials) are going up, or for some other reason their margins are significantly lower on their affordable products. So they’re selling plenty of them – but making far less per sale.

That’s on the profit side, but the revenue are also down….and at a time when the comps should be very favorable comparing to the big slowdown in housing from 2018.