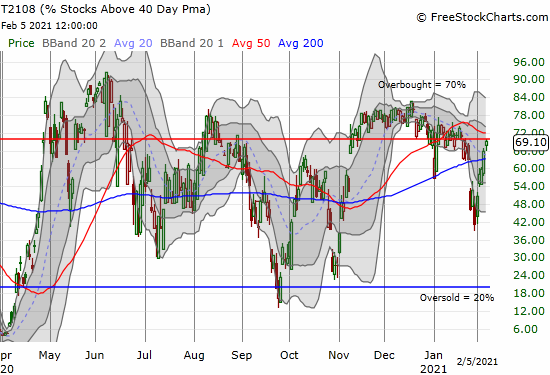

A New Low in Volatility Brought Fresh Promise to Overbought Stock Market – Above the 40 (February 12, 2021)

Stock Market Commentary After sweeping away bearish signals, the stock market moved right into overbought territory last week. The week started with a small gap up to all-time highs, and the stock market never looked back. More importantly, the volatility index (VIX) hit a new low since the stock market broke down almost a year … Read more