A Familiar Theme As Indices Leave Latest Troubles Behind – The Market Breadth

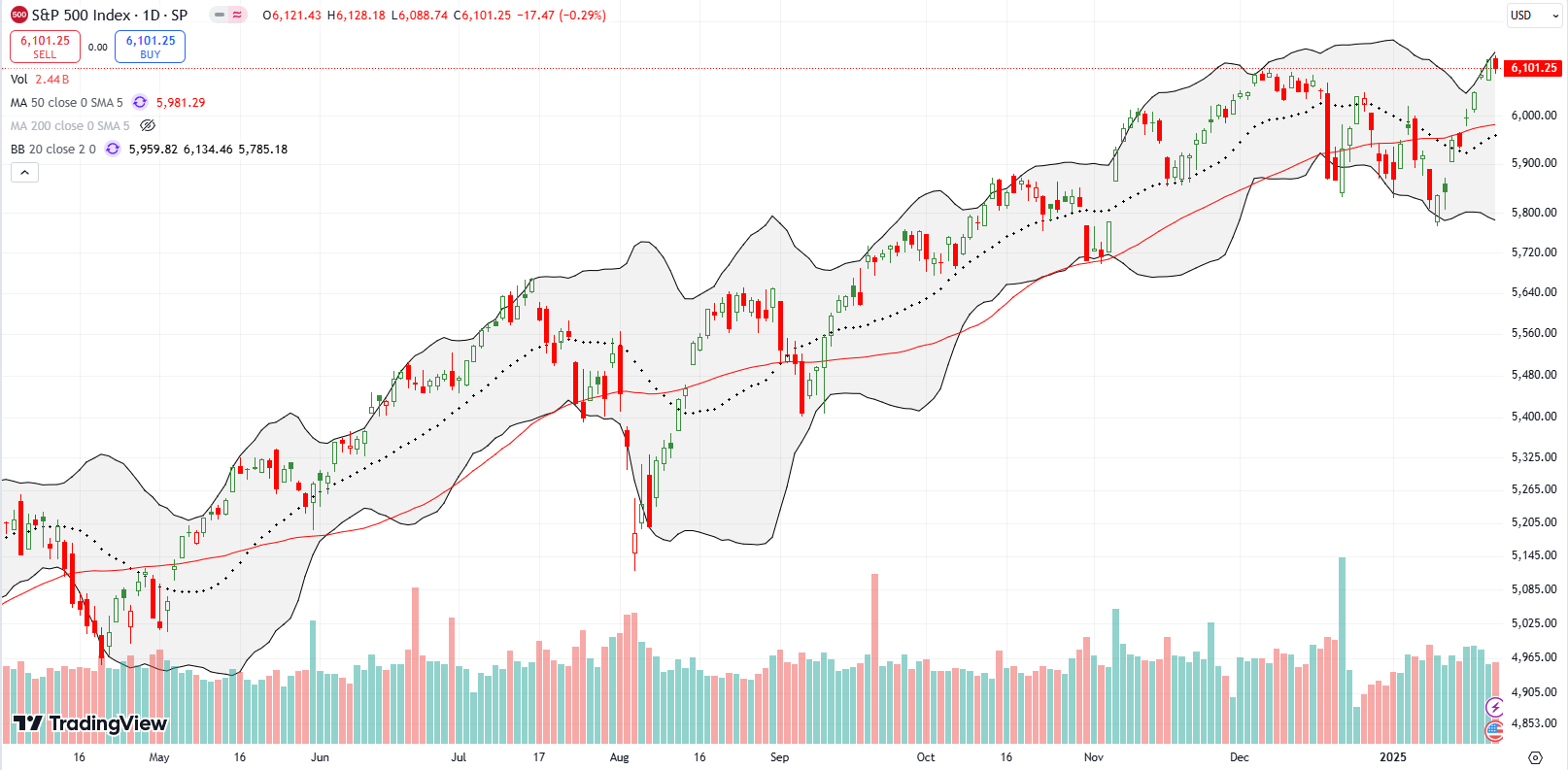

Stock Market Commentary Two weeks ago I wrote how a “A DeepSeek Dive and A Tariff Toll” created the next shift in the market’s technical outlook. I stepped back from a bullish position on the market as a result. Now, a familiar theme has unfolded with the stock market looking ready to leave its latest … Read more