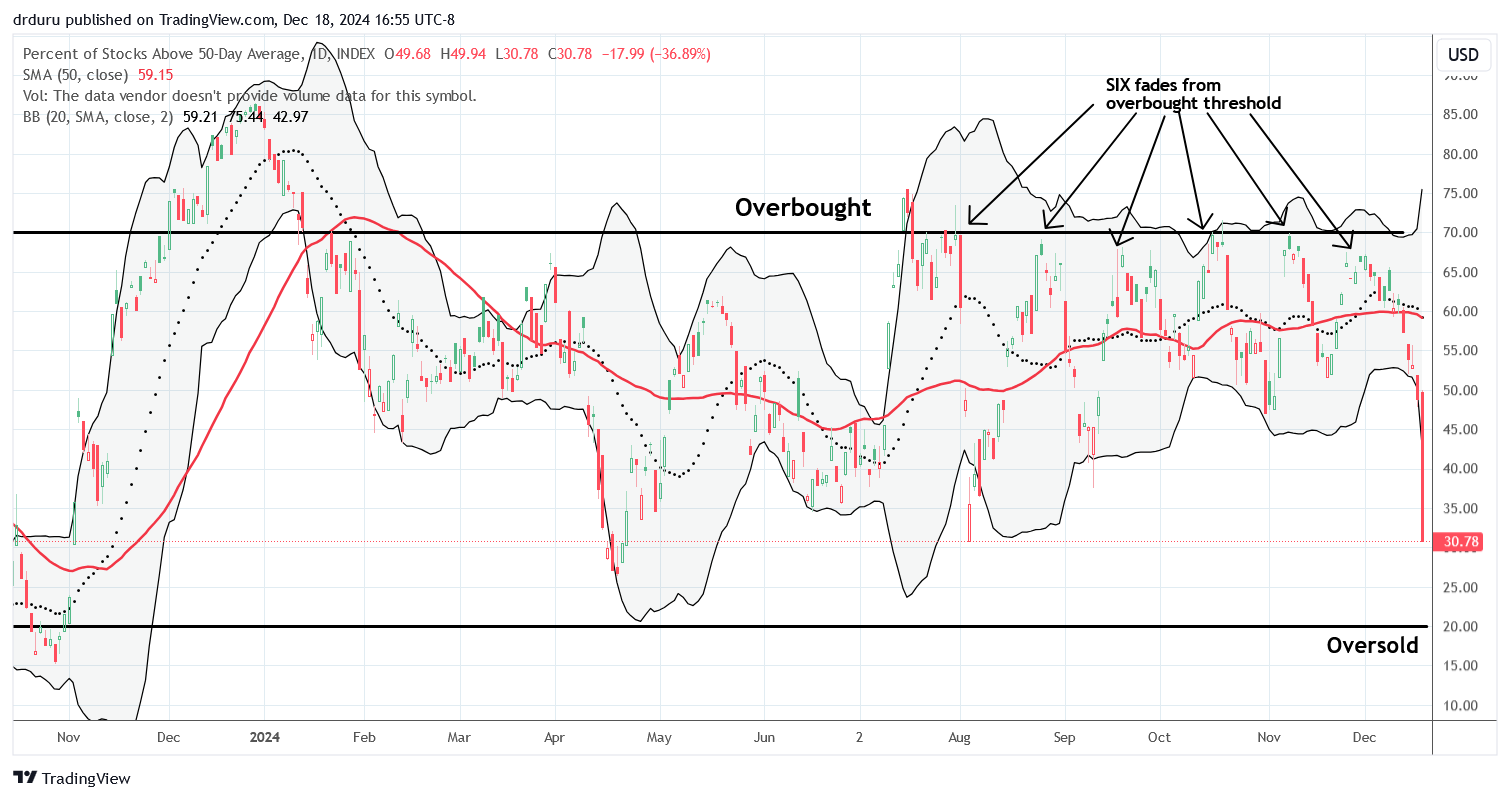

From Euphoria to Oversold In A Day? – The Market Breadth

Stock Market Commentary If you followed December’s deterioration in market breadth and/or paid attention to the inflation numbers and the smoke signals from the Federal Reserve, today’s market sell-off does not surprise you. What surprises me at the time of writing is the complete collapse in market breadth. The stock market essentially plunged from euphoria … Read more