What Happened in the Housing Market – A Spring Selling Season Bust

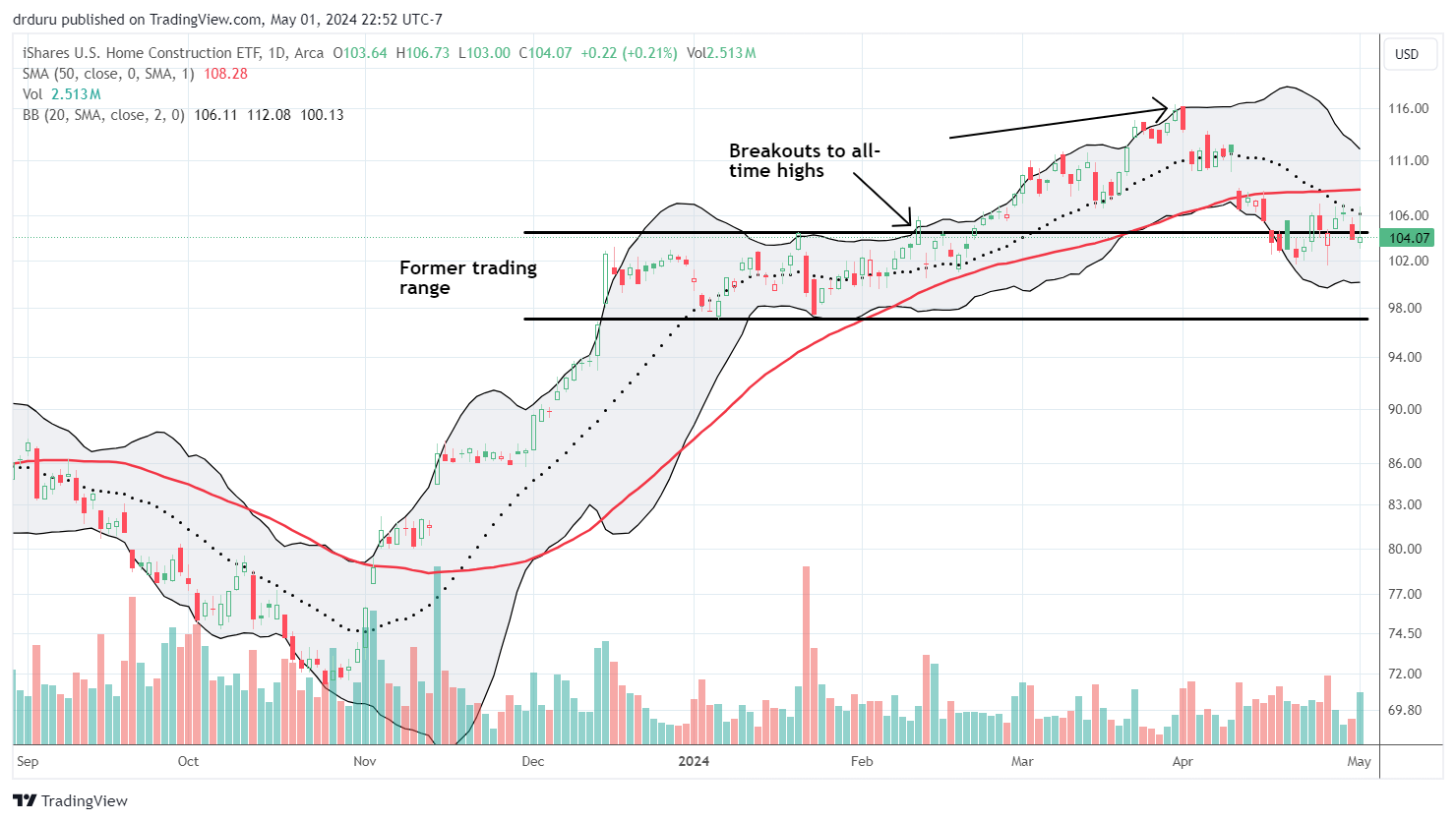

Housing Market Intro and Summary What happened in the housing market in June, 2024? The broadening weakness I described in my previous Housing Market Review continued and confirmed a spring selling season bust. The data in June delivered a picture of a sales slowdown accompanied by increasing affordability squeezes despite inventory increases. Housing Stocks The … Read more