A Gathering Storm of Confirmed 50DMA Breakdowns Fail to Trigger Oversold Signal – Above the 40 (October 30, 2020)

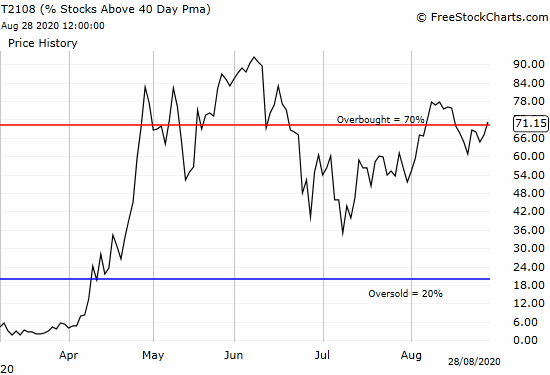

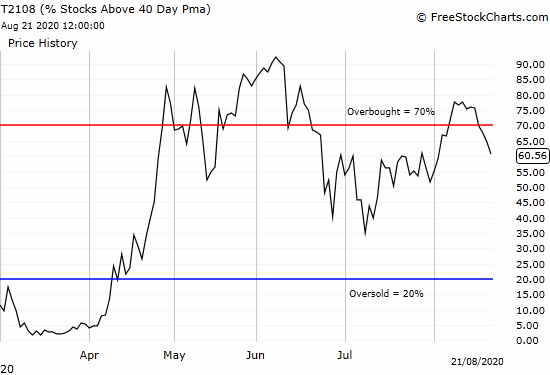

Stock Market Statistics AT40 = 26.5% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 44.5% of stocks are trading above their respective 200DMAs (8-month high) VIX = 38.0 Short-term Trading Call: cautiously bullish Stock Market Commentary A little over a week ago, the stock market looked poised to launch higher … Read more