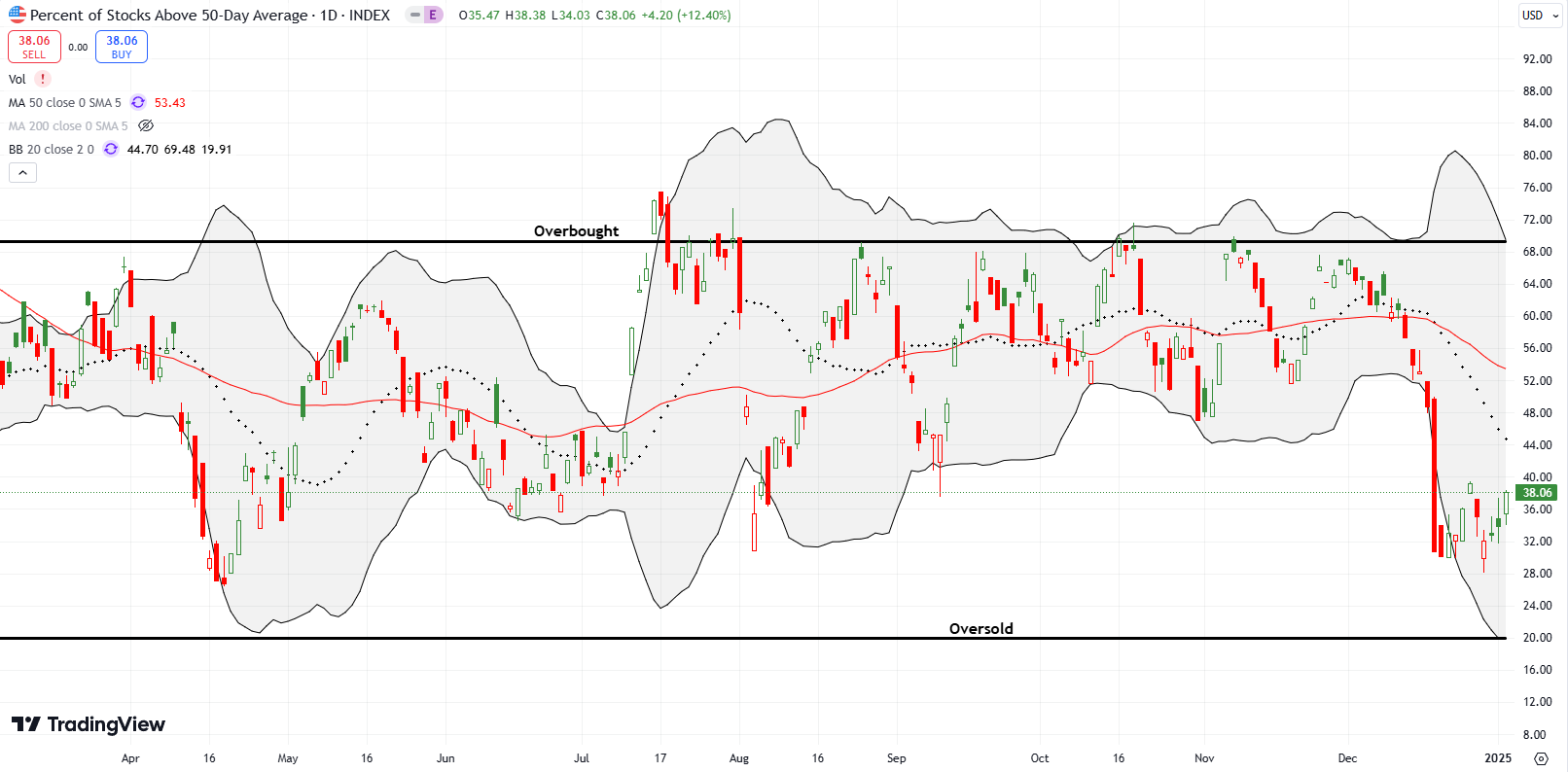

Was the Stock Market “Oversold Enough”? – The Market Breadth

Stock Market Commentary The week opened with market breadth dropping to within five percentage points of the oversold threshold. This was the closest encounter with oversold since late October, 2023. The stock market never looked back from there. A favorable mid-week inflation report helped propel the stock market with the assistance of declining long-term bond … Read more