A Lazy Holiday Week Sets Up December Buys – The Market Breadth

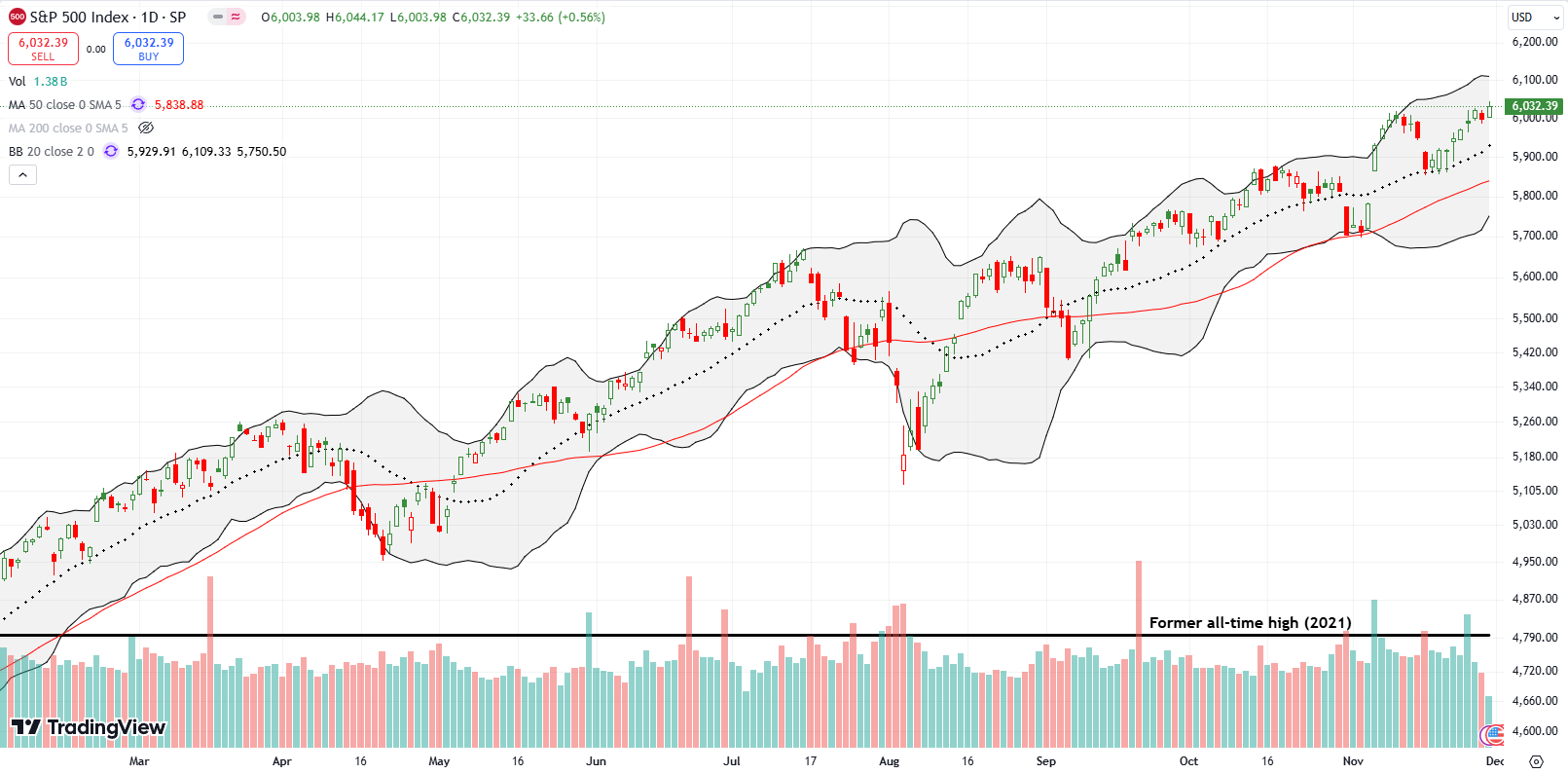

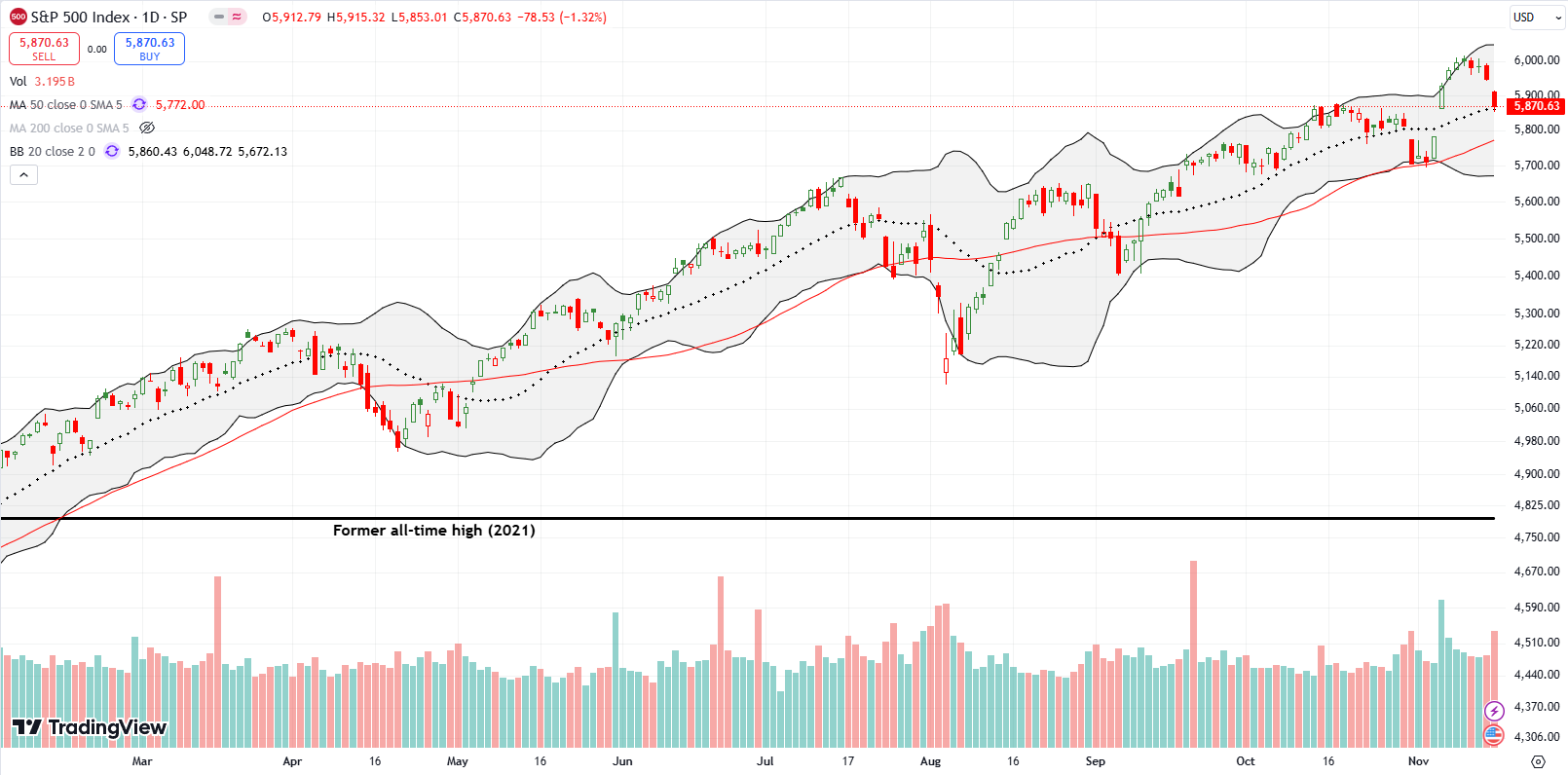

Stock Market Commentary Holiday trading last week was deceptively lazy. The indices did a lot of churning, yet the S&P 500 and the ETF of small caps each made all-time highs at some point. A good number of individual stocks developed and followed through on bullish setups. For example, all week long, new highs greatly … Read more