Market Breadth Yawned As Fed Rate Cut Fuels Continued Melt-Up – The Market Breadth

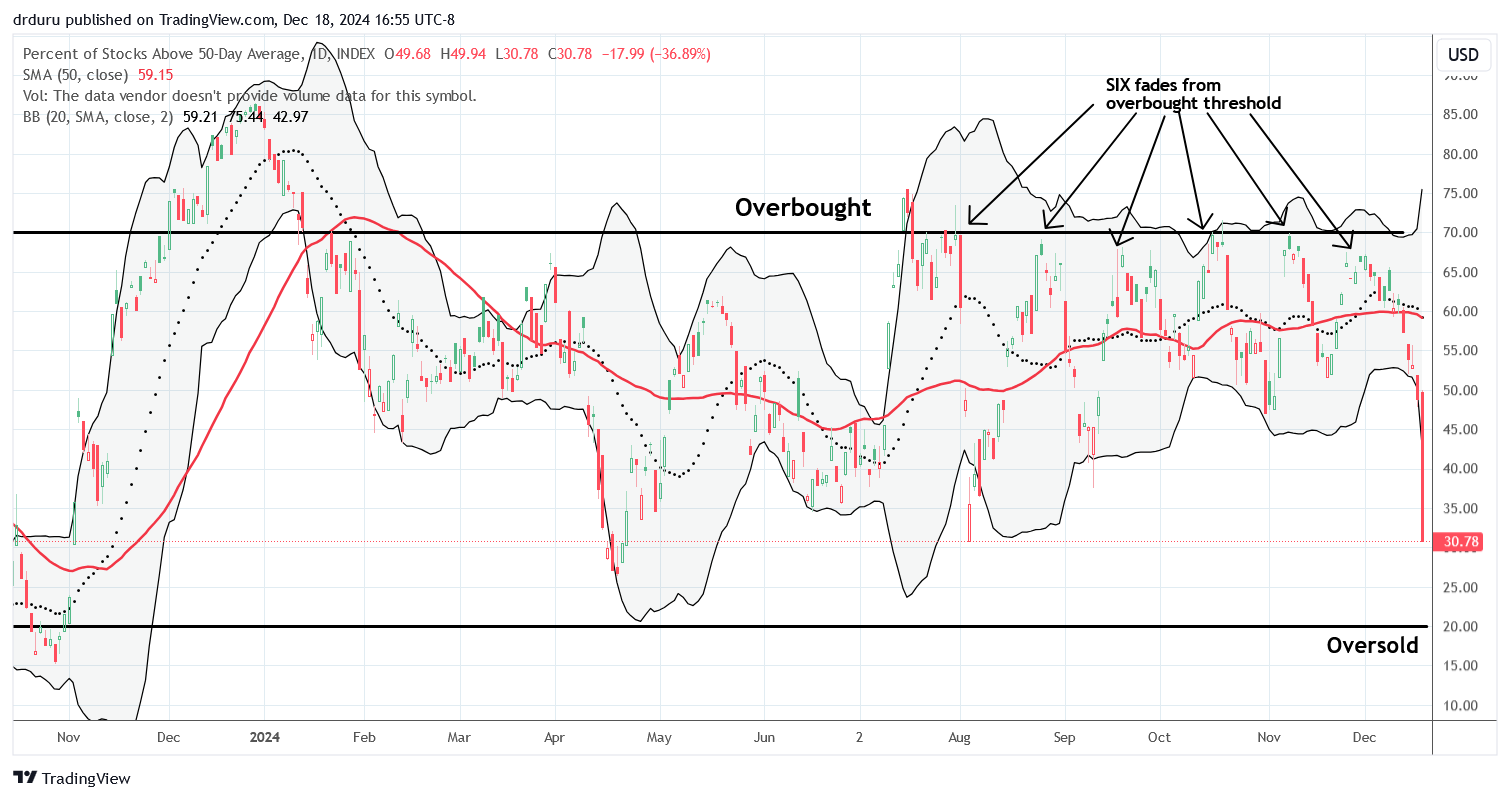

Stock Market Commentary Last week was billed as another marquee Fed week. While decision day brought a lot of intraday volatility, the churn became a mere speedbump as market breadth yawned and the stock market melt-up continued. The main message I heard from the Fed was an acknowledgement of an economy weak enough to warrant … Read more