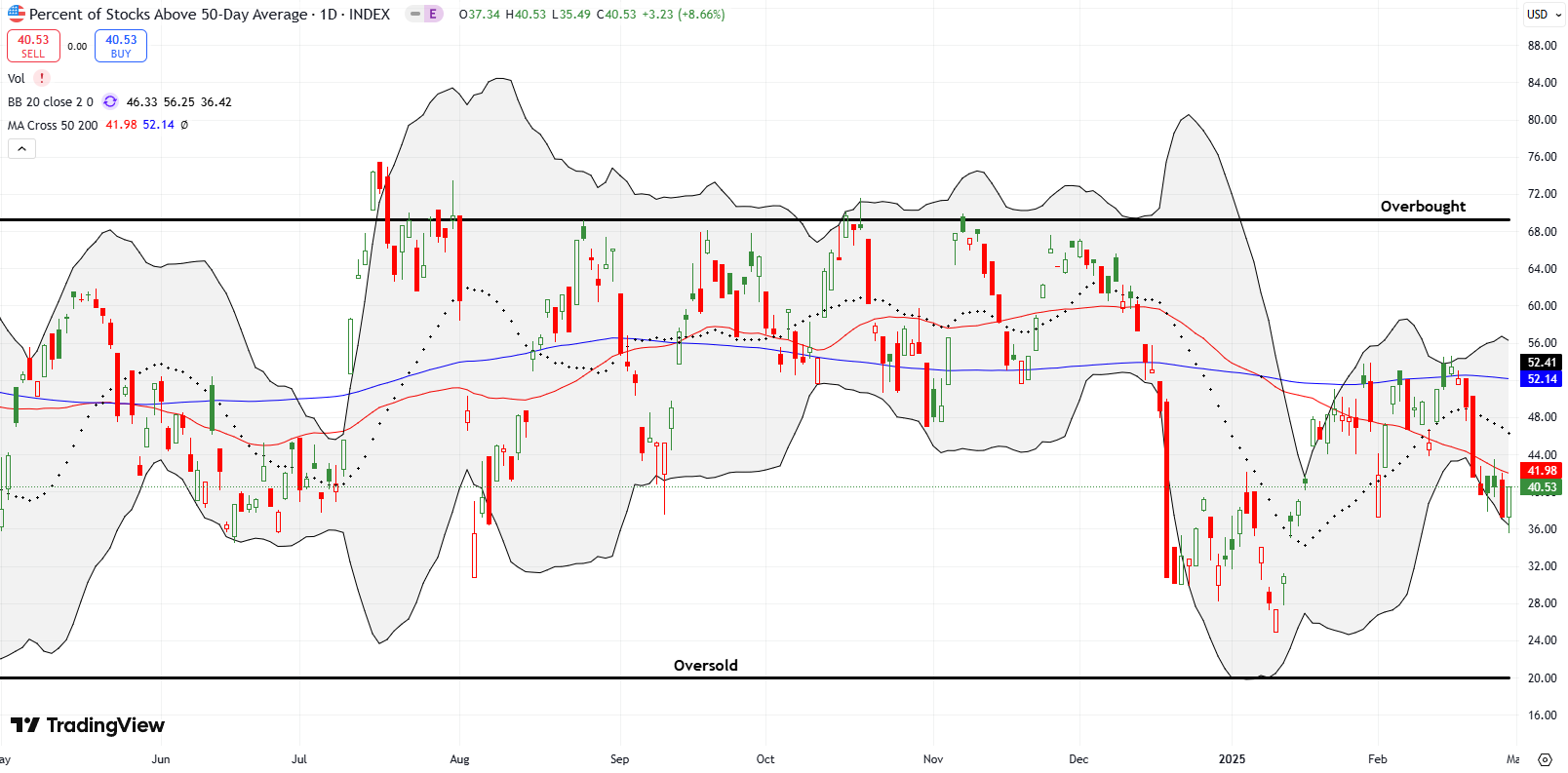

Reality Bites Rotten Eggs – The Market Breadth

Stock Market Commentary Reality bites. And right now those bites are clamping down on rotten eggs in the form of a swift repricing of risk. Once high priced eggs are now eggs few shoppers want. Last week’s theme of bring the pain continued in force at this week’s open: more economic uncertainty, more economic fears, … Read more