How to Use ChatGPT to Test Theories on Stock Prices

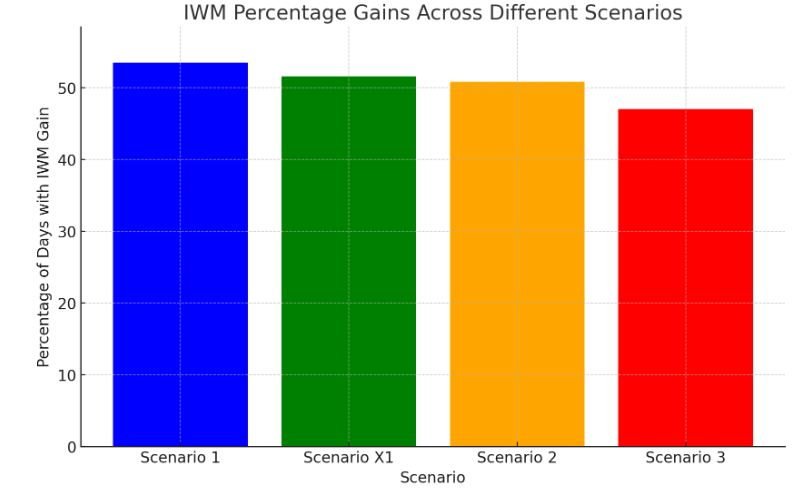

I have a good friend that comes up with interesting theories about relationships in the stock market. Recently, he claimed that “more often than not”, on a day where the big cap stocks gain and the iShares Russell 2000 ETF (IWM) does not gain, IWM will experience a daily gain on the next trading day. … Read more