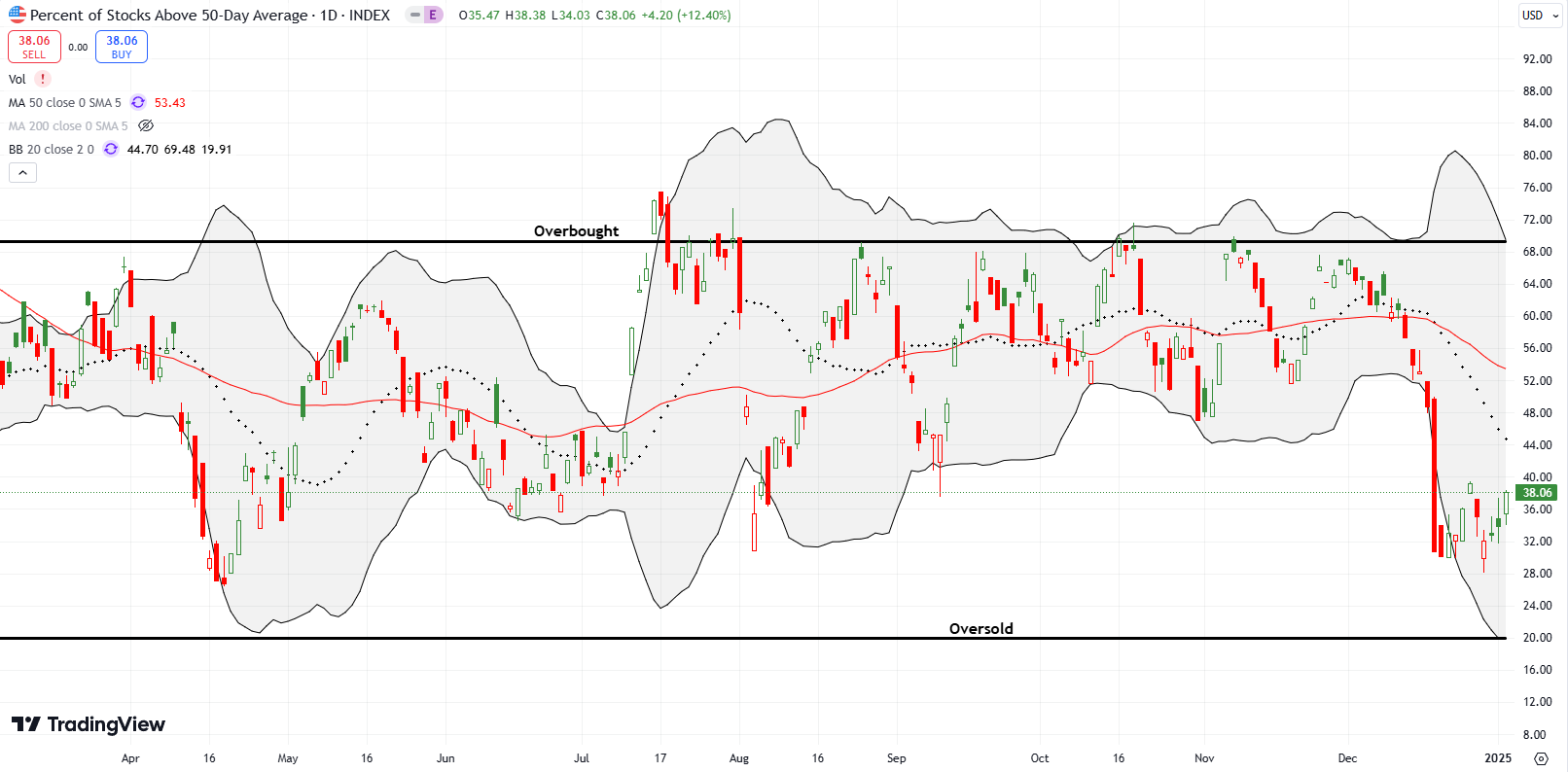

Buyers Fight Off AI Bubble Fears With A Partial Rescue from Breakdowns – The Market Breadth

Stock Market Commentary Media coverage of bubble talk in AI has become increasingly urgent and loud in recent months. Legendary short seller Michael Burry seemed to ring the clarion call when news dropped on Tuesday (November 4) about a massive bearish bet against NVIDIA (NVDA) and Palantir (PLTR). NVDA fell 4.0% that day. The downward … Read more