A Resilient Stock Market Barely Blinks At Fresh Bearish Signals – Above the 40 (January 3, 2020)

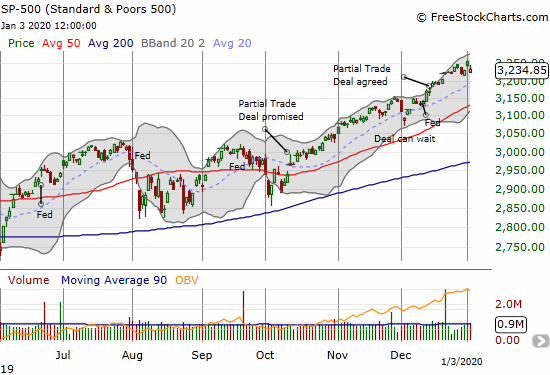

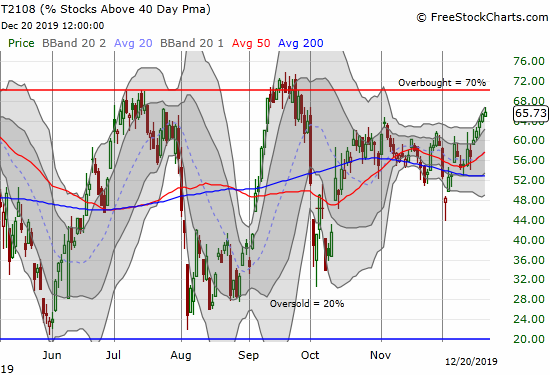

AT40 = 63.5% of stocks are trading above their respective 40-day moving averages (DMAs)AT200 = 60.3% of stocks are trading above their respective 200DMAsVIX = 14.0Short-term Trading Call: neutral Stock Market Commentary The stock market started the new decade with wild swings. After starting the first trading day of the decade with a 0.8% gain … Read more