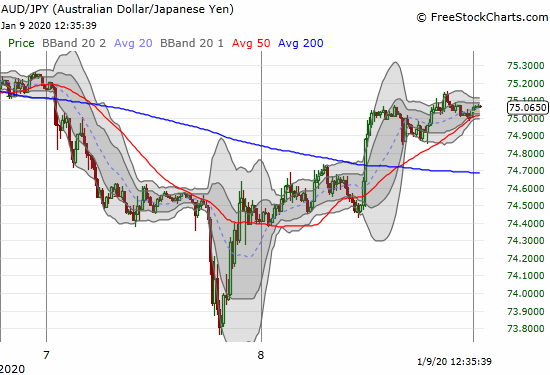

AUD/JPY: A Key Tell for the Week’s Post-War Bottom

Last week’s geo-political drama had all the makings of an escalation to all-out war. A country incensed about the assassination of its top general lobbed missiles at airbases its enemy occupies in a neighboring country. Everyone braced for the typical response of attacking the sites that lobbed the missiles. With its borders breached by the … Read more