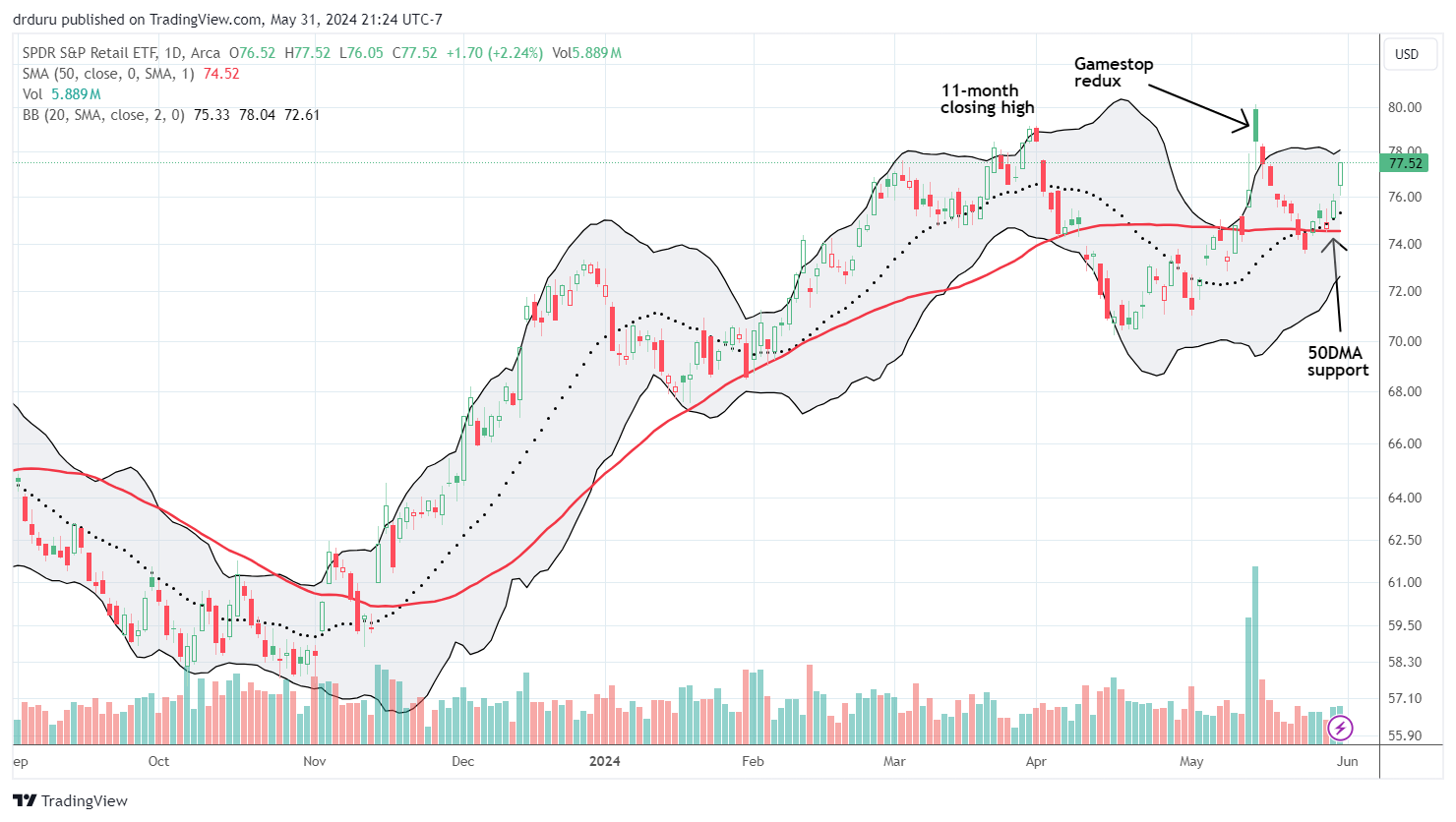

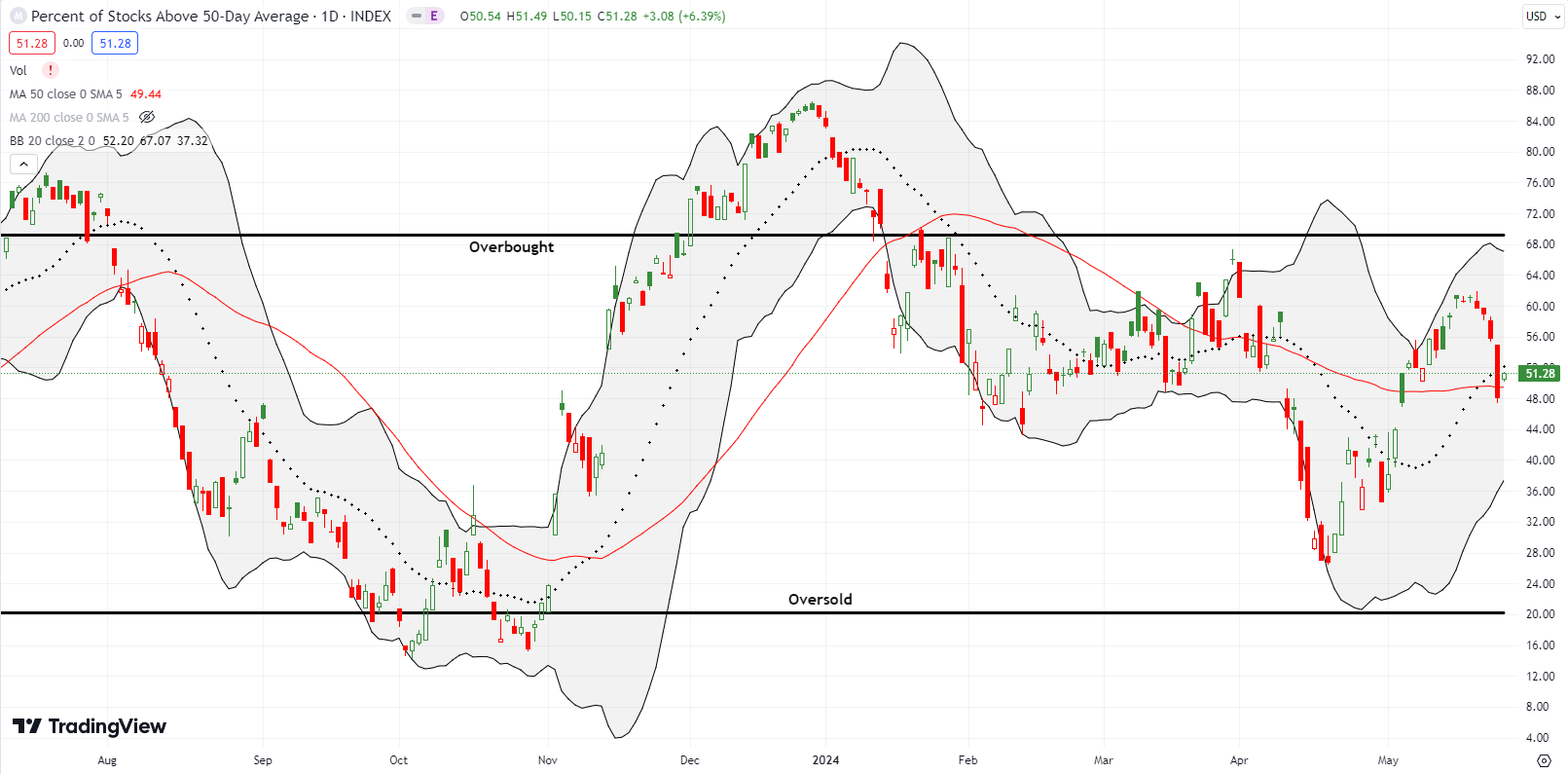

Market Breadth Waned Despite Stock Market All-Time Highs – The Market Breadth

Stock Market Commentary The week’s trading was punctuated by a single day with an all-time high on the S&P 500 and the NASDAQ in the wake of strong readings on the May S&P Global US Services PMI and the May ISM Non-Manufacturing Index. Unfortunately, that price milestone failed to change the contour of market breath … Read more