Overbought Conditions End with Fresh Market Risk – The Market Breadth

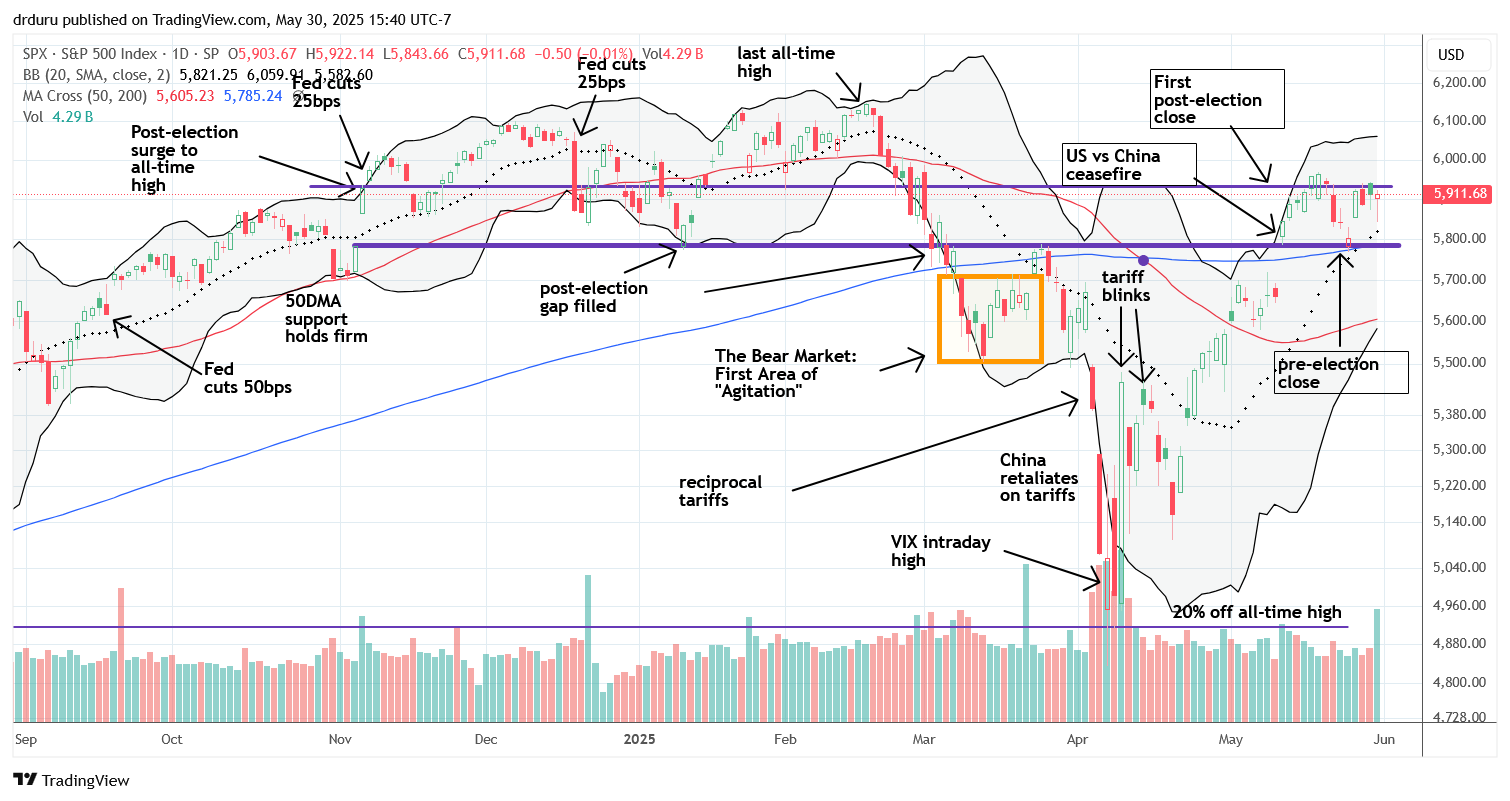

Stock Market Commentary The stock market’s fearless streak met fresh geopolitical headwinds that significantly raised the risk quotient. Tensions surged as Israel bombarded Iran’s nuclear infrastructure and Iran retaliated, spiking oil prices and triggering a market sell-off that, while sharp, could have and should have been a lot worse. This fresh market risk is a … Read more