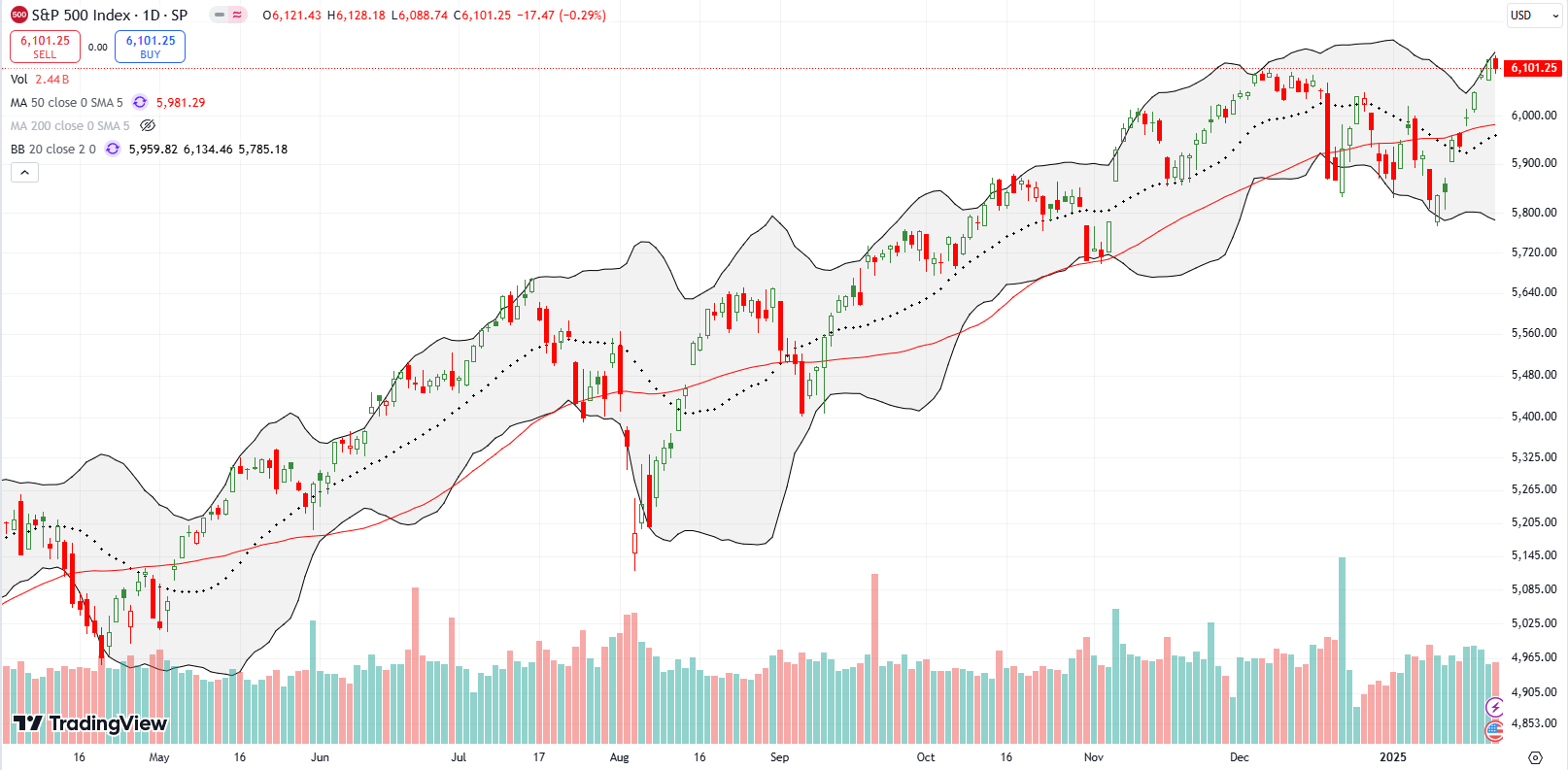

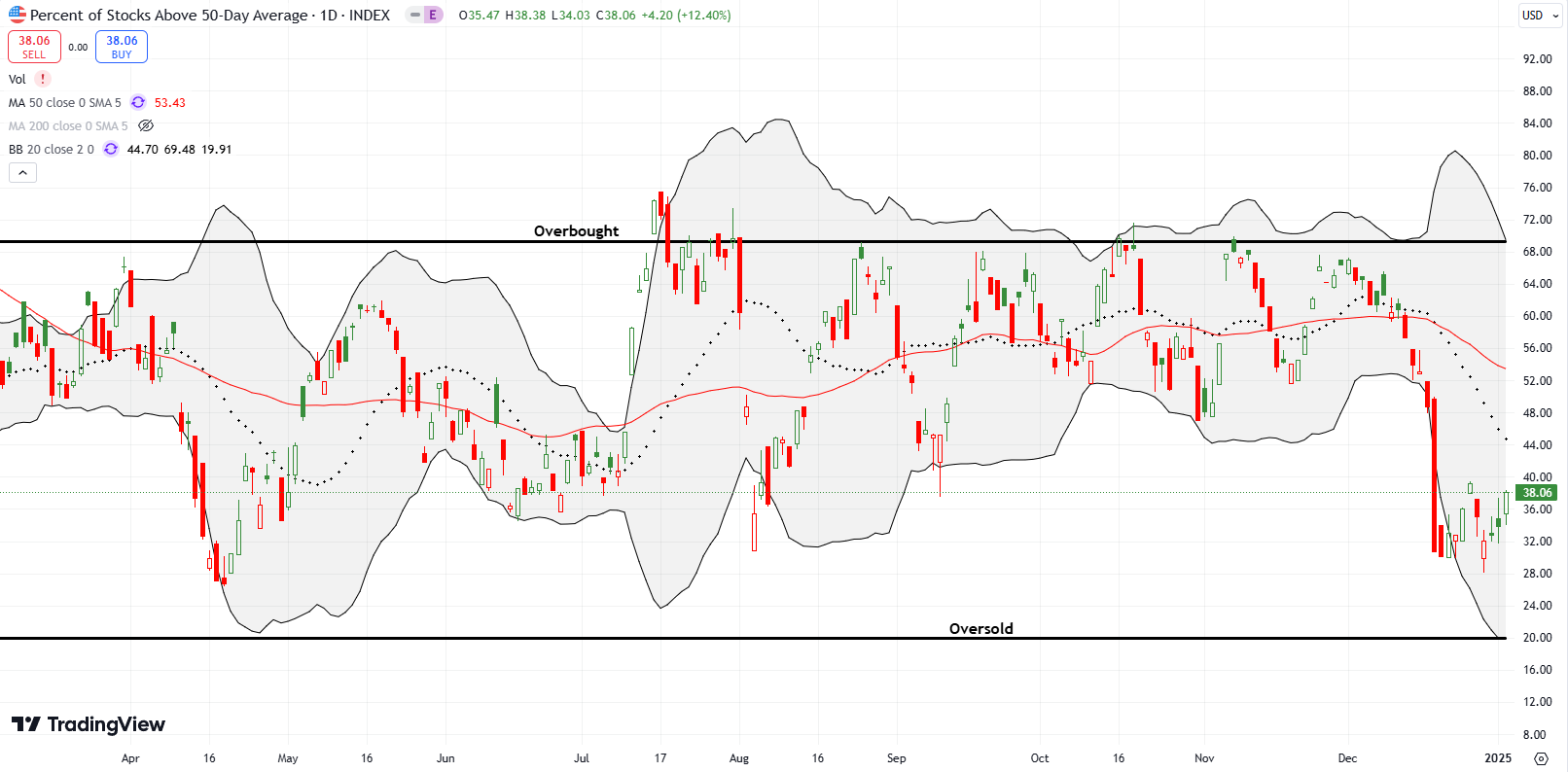

Oversold Enough Confirmed With All-Time High Redux – The Market Breadth

Stock Market Commentary A week ago, I concluded that the stock market had reached “oversold enough” trading conditions. Last week confirmed an oversold low as market breadth rapidly broadened and supported an all-time high redux for the S&P 500. Yet, this revival comes with important caveats. Uncertainty looms over the Federal Reserve’s next moves even … Read more