After the Plunge, A Quick Rebound Tests New Resistance – The Market Breadth

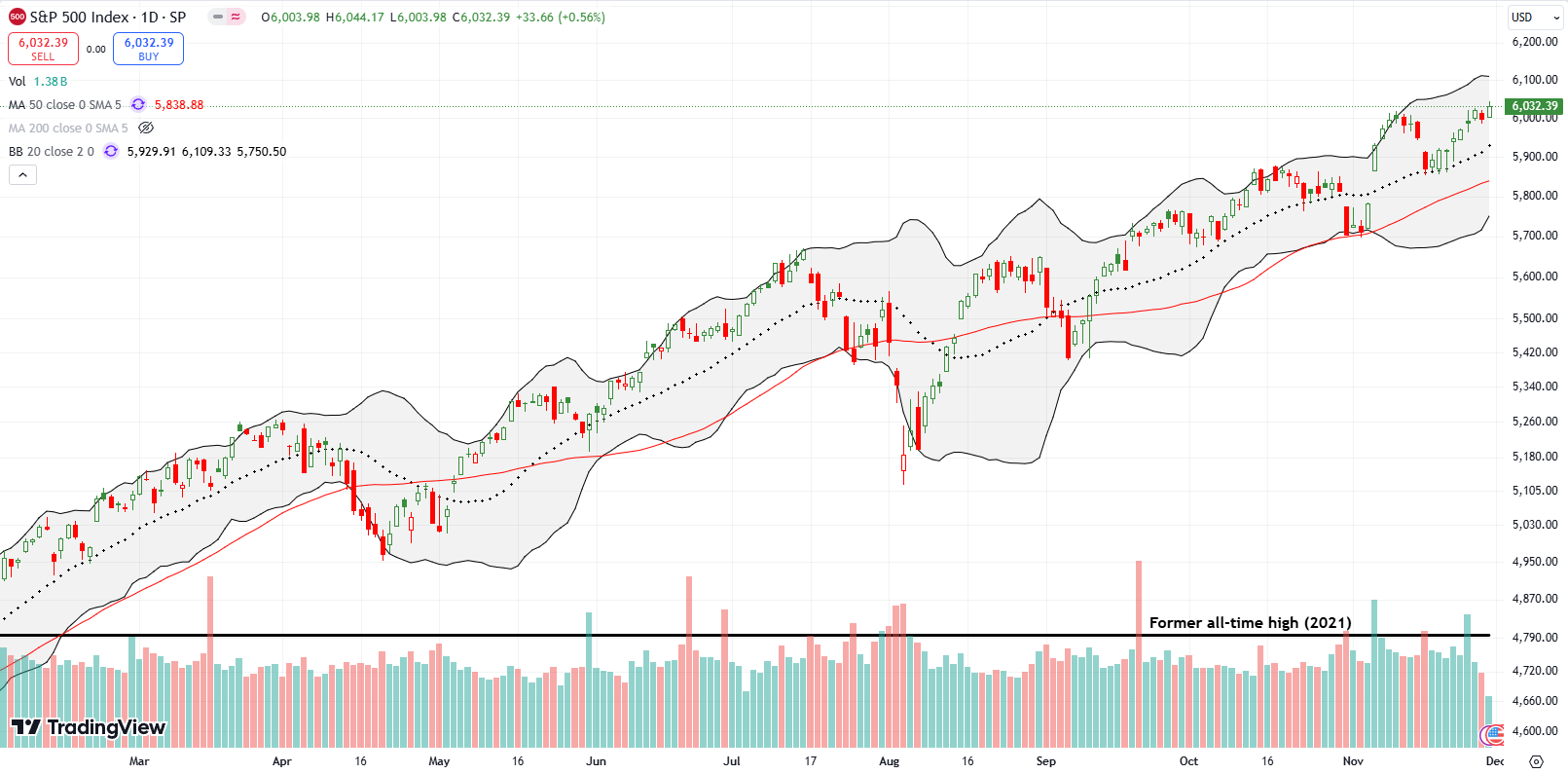

Stock Market Commentary The dust is settling ever so slightly on the stock market’s post-Fed plunge. The stock market shifted from euphoria to oversold on a day that woke up everyone to a potentially new market reality. I say “potentially” because all year the market has been hit with bearish catalysts and quickly bounced back … Read more