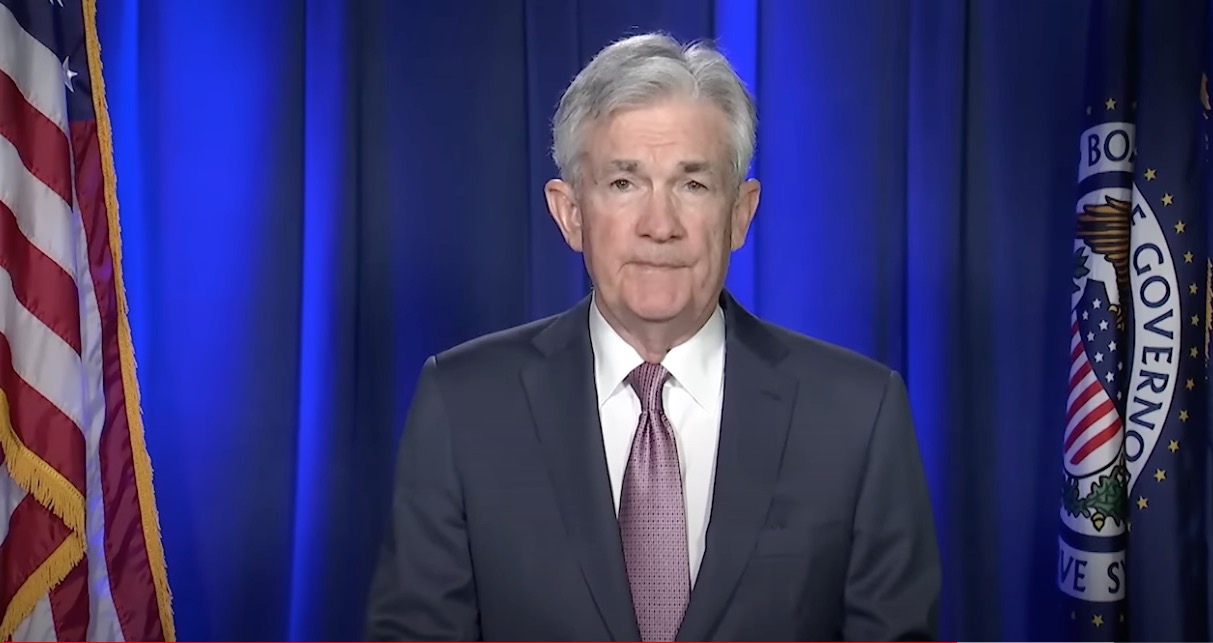

Hot Inflation Read Accelerated the Timeline for Peak Fed Rates

The landscape of inflation and monetary policy continues to change fast. The June inflation numbers disappointed expectations once again for peak inflation. A surprise 1% point rate hike by the Bank of Canada combined with this hot inflation accelerated the timeline for peak interest rates from the Federal Reserve. Instead of a 75 basis point … Read more