Post-Election Reversal Tests Support After Confirming Bearish Signal – The Market Breadth

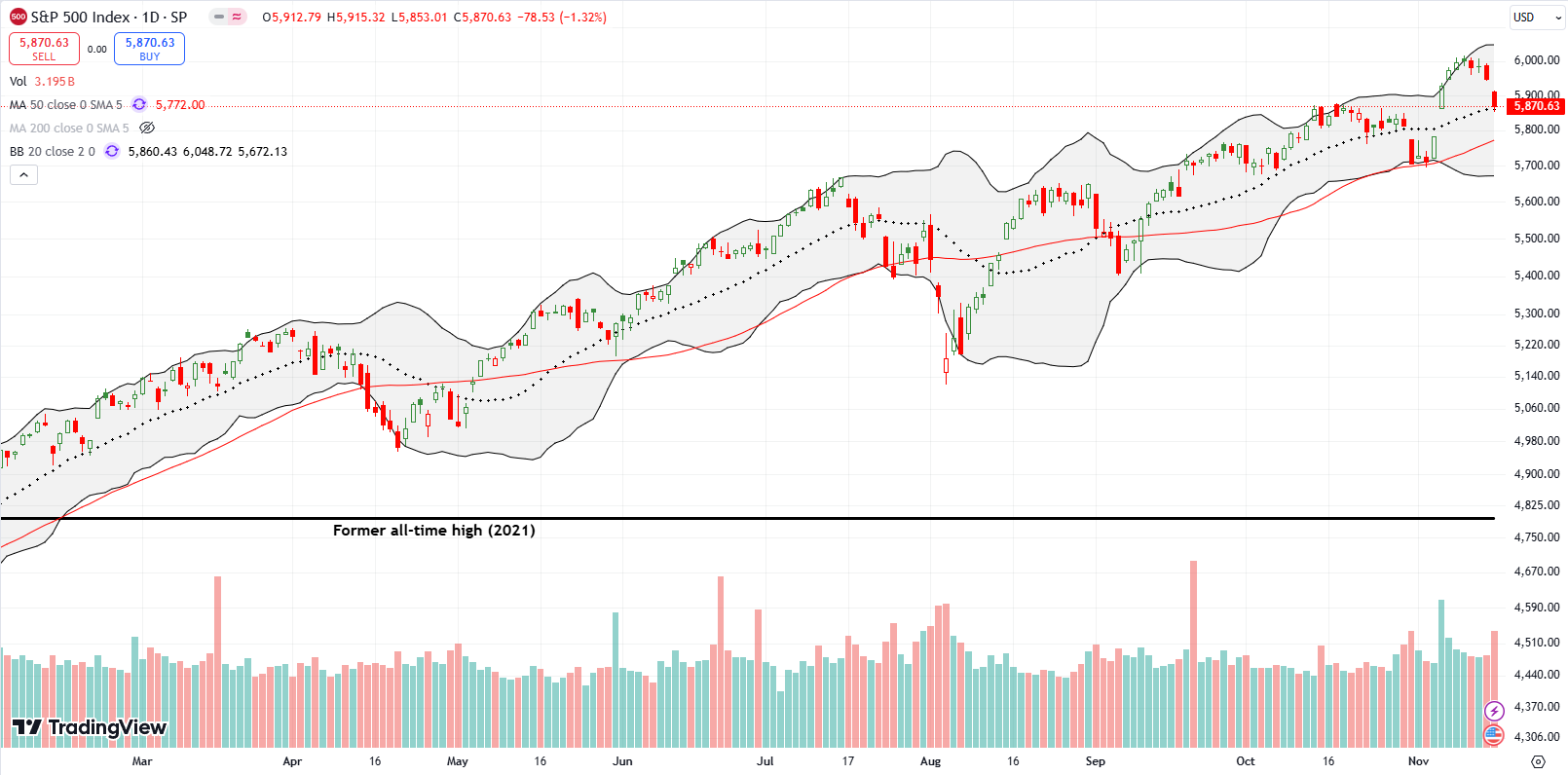

Stock Market Commentary The stock market has a natural law of “physics.” Overly enthusiastic trading, whether up or down, eventually meets an opposite and sometimes equal force. This natural instability of extremes forms a basis of my market breadth trading rules. The enthusiastic post-election surge exhausted buyers enough to create a post-election reversal. Moreover, my … Read more