Turkish Central Bank Hiked Policy Rate, But Too Late for the Turkish Lira?

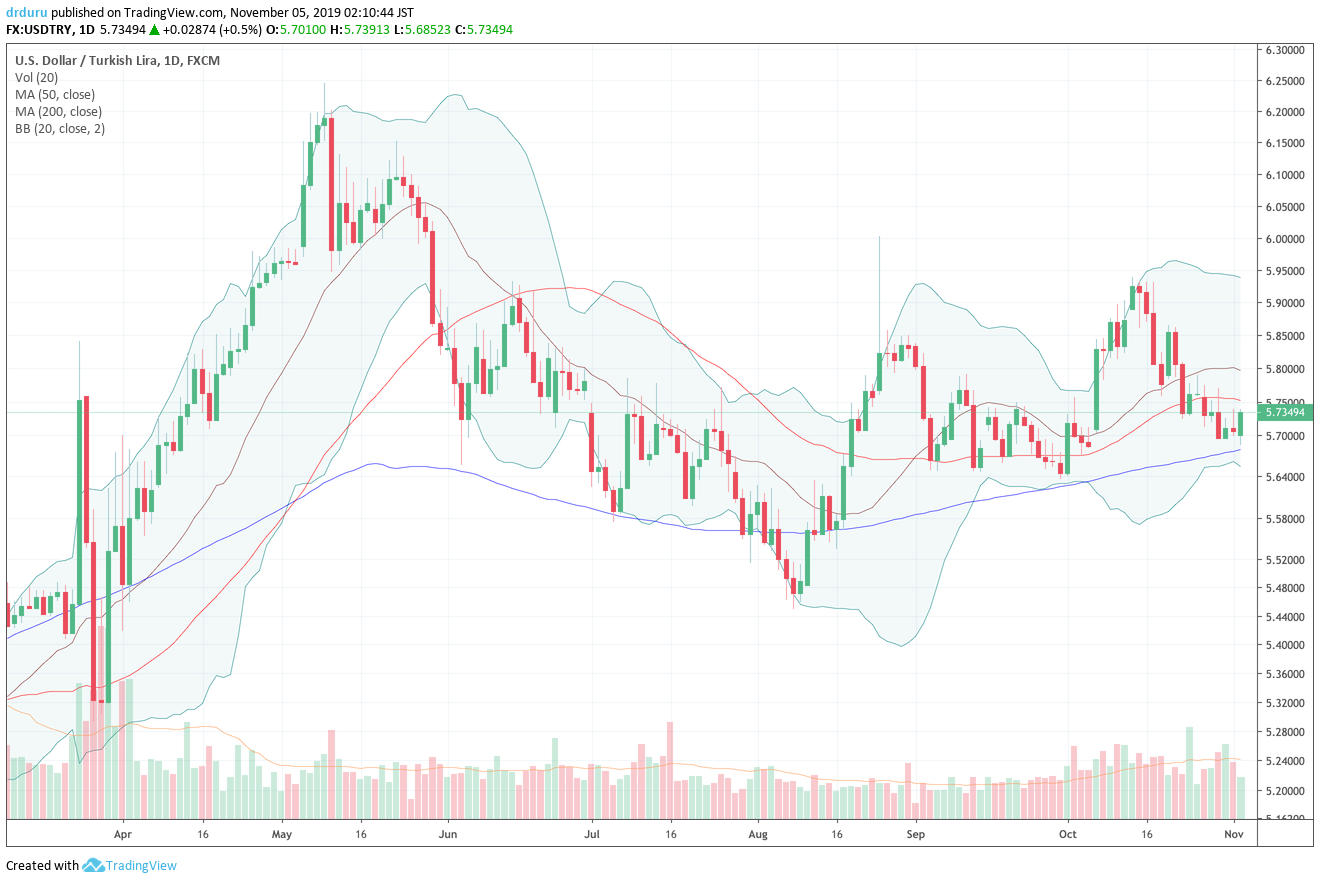

The Turkish lira suffered another run of sustained weakness this month. Weakness in the Turkish lira drove USD/TRY to new all-time highs. On Thursday, the Central Bank of the Republic of Turkey (CBRT) tried yet again to stop the bleeding. The Turkish Central Bank hiked its policy rate an entire 200 basis points from 8.25% … Read more