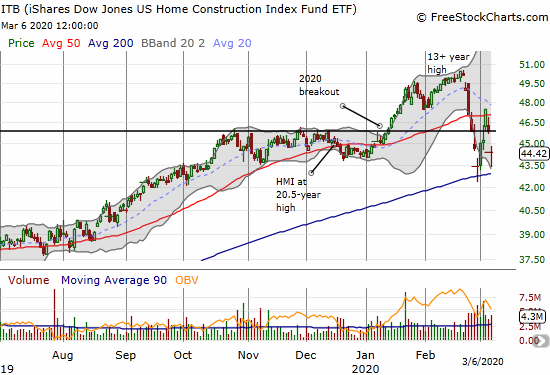

First the good news. The iShares Dow Jones US Home Construction Index Fund ETF (ITB) lost 3.2% on Friday but bounced sharply from the lows of the day. That bounce preserved support at the uptrending 200-day moving average (DMA) and set the stage for a potential higher low that generates a lasting bottom.

While, the S&P 500 (SPY) “only” lost 1.7% on Friday, ITB still maintains a performance advantage for the year. ITB is exactly flat year-to-date, and the S&P 500 is down 8.0%.

Now for the sets of bad news. There are a series of housing and construction stocks that are raising alarm bells for me given they hit new lows for this selling cycle. Here is the list with year-to-date performances and any important technical notes:

- Beazer Homes (BZH): -14.6%, second 200DMA breakdown

- Five Point Holdings (FPH): +3.3%, 200DMA breakdown

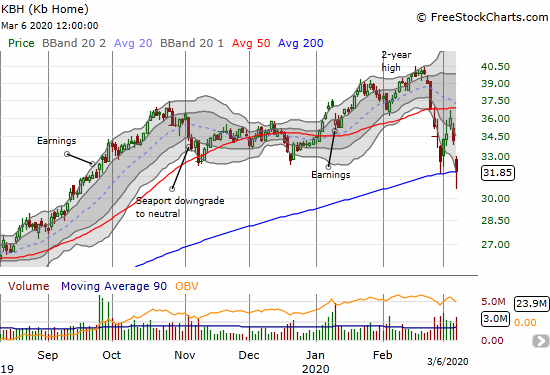

- KB Home (KBH): -7.0%, closed on 200DMA support

- M/I Homes (MHO): -6.8%, 2nd 200DMA breakdown

- Owens Corning (OC): -21.9%, 9-month low

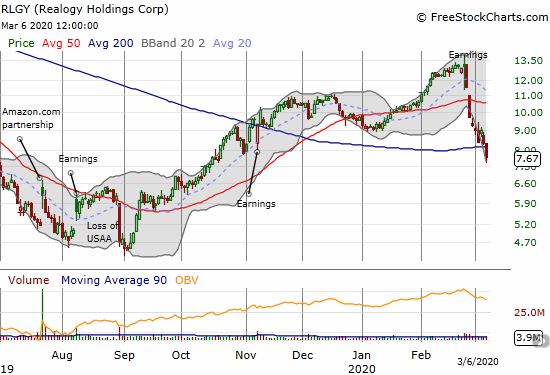

- Realogy Holdings Corp (RLGY): -20.8%, 200DMA breakdown

- Redfin (RDFN): +24.9%, bounced off 50DMA support after finishing a reversal of post-eanrings gains

- Taylor Morrison Home Corporation (TMHC): -0.7%, confirmed 200DMA breakdown

- U.S. Concrete (USCR): -40.8%, 5 1/2 year low

Each company and stock has its own story, but their collective under-performance and breakdowns could be signs of more weakness to come for the industry. A growing list of stocks in the industry hitting new lows for this cycle will be a key tell.

Beazer Homes (BZH) is a speculative home builder that periodically becomes fashionable with traders. BZH hit a near 2-year high in January before a post-earnings collapse signaled the end of the run for BZH. I expect BZH to eventually return to its lows of 2019, another 25% or so lower.

Five Point Holdings (FPH) is particularly disappointing. I am a long-term investor in this stock and recently wrote about its stellar rebound. FPH has almost reversed its complete resurgence that started in January.

M/I Homes (MHO) produced an uninspiring earnings report that left me uninterested in adding it to the buy list for the seasonal trade. A second 200DMA breakdown leaves the stock with a confirmed double-top as well as a complete reversal of its October breakout – a very bearish combination.

Owens Corning (OC) is a materials company that caught my attention again last June when an activist investor started making noise. I rode the subsequent rally for most of the year. I have been looking for a new entry ever since. The current breakdown in the stock is bearish, but I cannot resist these cheap valuations for long: 1.3 price/book, 0.9 price/sales, 10.9 forward P/E (from Yahoo Finance). Of course these ratios are all at risk if OC’s financial results plunge along with the stock.

Redfin (RDFN) produced strong earnings and a great narrative. I finally bought into the stock in this pullback. RDFN had an impressive breakout and run-up going into this selling cycle. I wanted to buy into RDFN as a play for the year. I am now worried that economic risks may cut this story short, thus turning my position into a trade instead of an investment.

Taylor Morrison Home Corporation (TMHC) acquired William Lyon Homes in November. I did not like the acquisition then, and I still do not. I think the company is in a weakened financial position to ride out whatever economic turbulence may be ahead. The second and confirmed 200DMA breakdown back to post-acquisition lows signals volumes.

U.S. Concrete (USCR) is having one of those rough years. USCR started the year struggling to stabilize from significant post-earnings weakness. The latest market sell-off swiftly shaved another 30% or so off the stock. Given my residual bullishness in the company thanks to my interviews with retiring CEO Bill Sandbrook, I am looking at this deep sell-off as a buying opportunity. I am continuing to accumulate stock even as the company’s plunge signals trouble ahead for the construction industry in general.

KB Home (KBH)

KB Home (KBH) is a stock on my shopping list for the seasonal trade for home builders. I bought call options on the first leg down and sold them into the rally to 50DMA resistance. I accumulated call options again on this second leg down. If KBH survives this second test of 200DMA support, I expect the stock to break out from 50DMA resistance. I bought April expiration with that expectation.

Realogy (RLGY)

Realogy Holdings Corp (RLGY) is a company and stock I wrote skeptically about last year. From there, the stock soon rallied on earnings only to plunge on the loss of an account with USAA. After hitting a fresh all-time low, the stock put on a jetpack. The near 6-month run from $4.50 to over $13 truly astounded me. I suspect some kind of short squeeze was at work. According to Yahoo Finance, RLGY still has 37.6% of its float sold short. The 30.2M shares short in February is down from January’s 35.0M. Since I cannot imagine anything fundamentally changed with the business of this housing services company (mainly realty), I think it will be back to all-time lows in due time.

Source for charts: FreeStockCharts

Be careful out there!

Full disclosure: long KBH calls, long USCR, long ITB call options and call spread, long FPH