(This is an excerpt from an article I originally published on Seeking Alpha on September 29, 2013. Click here to read the entire piece.)

{snip}

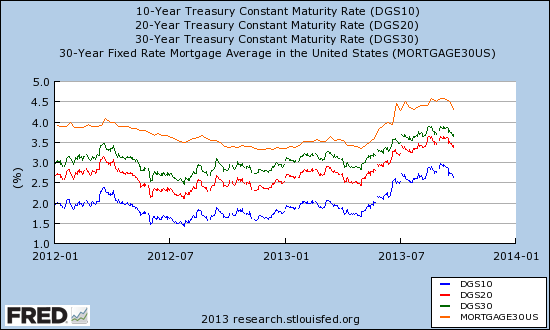

Source: St. Louis Federal Reserve

Homebuilder stocks joined most rate-sensitive plays by falling sharply from their lofty levels once the direction and momentum of rates became clear. {snip} I consider any of the dips that are likely to come in the next several weeks to represent particularly good buying opportunities.

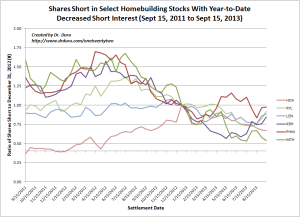

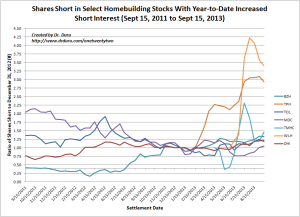

Interestingly, higher rates and weakening technicals for homebuilder stocks did not spike the interest of homebuilder bears. {snip}

{snip}

Click image for a larger view…

Source for data: accumulated from NASDAQ.com short interest

{snip}

I am keeping my eye out on the horizon because the housing recovery is just getting started. Homebuilding is still in a deep recession relative to past decades. The longer economic conditions suppress this building activity, the more pent-up demand grows in the system. {snip}

Source: St. Louis Federal Reserve

Source: St. Louis Federal Reserve

{snip} On Nightly Business Report, September 26, 2013 (start 11:30 in the video), Mark Hanson of M Hanson Advisors claimed that new home sales are currently only 7% of all home sales whereas typically they contribute about 20-25%.

{snip}

Some of the bearish arguments I have read latch on to every data point as a negative:

{snip}

{snip}

Anyway, I think a better framework for thinking about the housing recovery is to recognize that the industry is in the early stages of pulling out of a depression. The deflationist psychology inherited from the crashing of the bubble will take considerable time to heal. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 29, 2013. Click here to read the entire piece.)

Full disclosure: long TPH