(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2013. Click here to read the entire piece.)

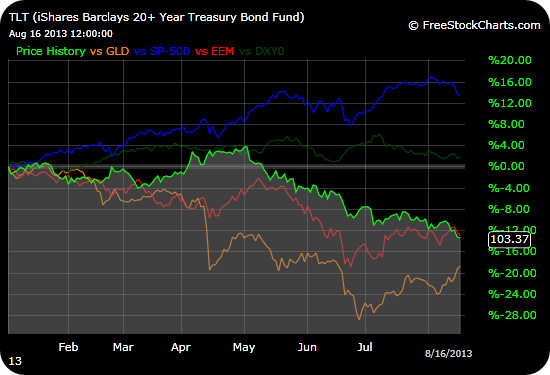

The mixed signals from financial markets continue as interest rates continue to climb. In fact, the steady rise in rates is the main feature within a swirl of inconsistent patterns. The head scratching reached some kind of climax when the U.S. dollar index (UUP) experienced a surprisingly sharp decline on Thursday (August 15th) even as interest rates shot up again. {snip}

Source: FreeStockCharts.com

{snip}

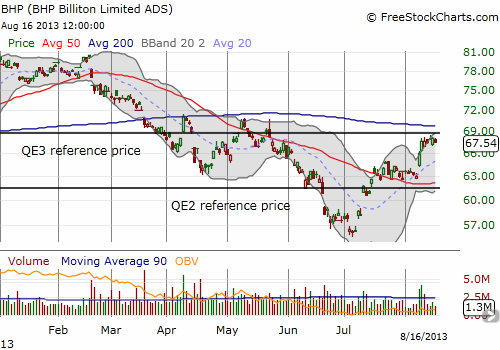

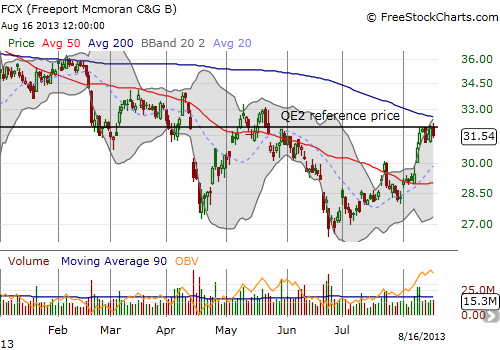

Other commodity-related names like Freeport-McMoRan Copper & Gold Inc. (FCX) and BHP Billiton Limited (BHP) have continued to rally off June lows in spite of rising rates. {snip}

Source: FreeStockCharts.com

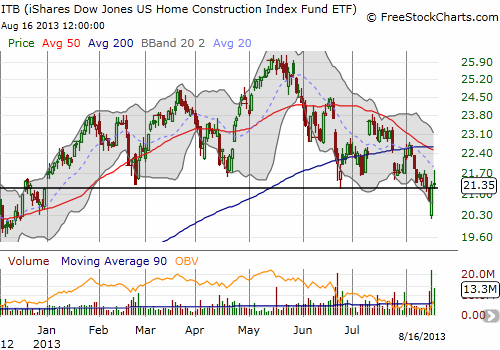

In the meantime, 30-year mortgage rates have finally managed to stabilize over the last month or so after a sharp 2-month spike that at one point was racing ahead of Treasury yields.

Source: St. Louis Federal Reserve

This could be the calm before the next storm. Thursday’s jump in rates sent the iShares Dow Jones US Home Construction Index Fund (ITB) further into negative territory for the first time this year before a strong intraday recovery. {snip}

Source: FreeStockCharts.com

{snip}

I am also VERY interested to see how Federal Reserve Chairman Ben Bernanke addresses the topic of tapering in this year’s Jackson Hole confab coming up this weekend. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2013. Click here to read the entire piece.)

Full disclosure: long SSO calls, TPH, TBT, GLD, net long the U.S. dollar, net long Australian dollar